The nursing home was alerted to the post after a nursing professor saw the post and shared it with the administration.

Although there have been a number of firings of nursing staff based off of their social media posts over the past few years, many of them deal with patient confidentiality. In this case, the employee’s violation of the nursing home’s social media policy– which he had signed with the receipt of his first paycheck– was what protected the nursing home from having to pay costly unemployment benefits to an employee who put patient safety and the reputation of the facility on the line.

If you haven’t already, it may be time to review your current social media policy to ensure that your mission, and reputation, are protected from similar situations.

Read more about the case in this article by the Nonprofit Quarterly.

A: Typically the temporary agency will ensure that their employees know the position they are filling is a temporary assignment. However, if you want to make it perfectly clear, you could ask the temporary agency to give them a letter of understanding structured like an offer letter (on the agency’s letterhead) outlining that the position is temporary through the agency and is expected to continue through [date], that they are ineligible for the contracting company benefits as they are not employees of [company], their employer of record is XX temporary agency, etc. This should ensure that there is no confusion concerning the promise of employment with the contracting company.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

This newest partnership will allow U.S. based organizations with a 501(c)(3) tax designation to more effectively take advantage of the federal law that allows nonprofits to opt out of the state unemployment tax system. By paying only the dollar-for-dollar cost of unemployment benefits paid to former employees, organizations that join UST lower their average claims cost to just $2,287 per claim versus the national average of $5,174 per claim.

“The ultimate goal of each and every nonprofit association that we work with is to provide their members with the best opportunities to advance their missions. By combining the power of hundreds, and sometimes even thousands, of smaller nonprofits, associations are able to get better money saving tools customized for their members,” said Donna Groh, Executive Director of UST.

“Last year we found more than $3.5 million in tax savings for nonprofits that came to us through our association partnerships. This year we want to double that and find at least $7 million in tax savings for our affinity partners’ member organizations.”

About the Alliance for Children and Families: The Alliance is a national organization dedicated to achieving a vision of a healthy society and strong communities for all children, adults, and families. The Alliance works for transformational change by representing and supporting its network of hundreds of nonprofit human serving organizations across North America as they translate knowledge into best practices that improve their communities. Working with and through its member network on leadership and advocacy, the Alliance strives to achieve high impact by reducing the number of people living in poverty; increasing the number of people with opportunities to live healthy lives; and increasing the number of people with access to educational and employment success. For more information, visit Alliance1.org. About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

The Unemployment Services Trust (UST) is pleased to announce that the Delaware Alliance for Nonprofit Advancement (DANA) has endorsed UST as a new Affinity Partner—making DANA the 15th state nonprofit association to bring UST to their members. UST will now join the other cost-saving member benefits offered to DANA member organizations and will offer resources to help them maintain HR best practices and standards, and reduce unemployment-related costs.

The UST program helps 501(c)(3) organizations take advantage of the federal law that allows nonprofits to opt out of the state unemployment tax system. By paying only the dollar-for-dollar cost of unemployment benefits paid to former employees, organizations that join the Trust see their average unemployment claim cost fall to $2,287, versus the national average of $5,174 per claim.

“We are thrilled to have DANA join us as an Affinity Partner because we know there is ample opportunity to help their members thrive. We want to help Delaware agencies, with 10 or more employees, discover whether they are overpaying their state unemployment taxes,” explained Donna Groh, Executive Director of UST. “We make it our mission to provide nonprofits with the latest tools and information required for organizational growth – and having the power to better educate these Delaware nonprofits through DANA can only help us strengthen the nonprofit sector.”

“We are proud to partner with UST to bring their unemployment and HR resources to Delaware,” says Chris Grundner, President and CEO of DANA. “We’ve seen the impact and savings they provide in other states, and we’re glad to now see our members benefit from their expertise and high-quality customer service.”

About the Delaware Alliance for Nonprofit Advancement (DANA): As a leader of the nonprofit sector, DANA’s mission is to strengthen, enhance, and advance nonprofits and the sector in Delaware through advocacy, training, capacity building, and research. For more information, visit DANA’s website at www.DelawareNonprofit.org.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with nearly 80 state and national nonprofit-based associations to teach their members about their unemployment insurance options. Visit www.ChooseUST.org to learn more.

Written by Karen Beavor and re-published by permission of the Georgia Center for Nonprofits Just as important as developing a deep individual relationship with each board member, it’s also important to understand what your team of individuals amounts to, and what qualities, skills, and connections it still needs to fulfill all your organization’s strategic goals—that is, to become a well-rounded, fully-functional superteam capable of taking on any challenge. If constructed wisely, your board can work as your organization’s personal consulting team.

To figure out what kinds of individuals your team has, and what skills it still needs, you need a process for discerning assets and talent gaps on your board, in relation to your strategic goals. To do that, I advocate laying out your strategic goals and the skill sets necessary to achieve those goals, then determining which of those skill-sets your board already has on-hand. In our years training nonprofit EDs and boards, Georgia Center for Nonprofits has developed a simple method for producing three handy reference charts that will align your organization’s goals with the skills available from the board. Properly aligned, that board can effectively drive initiatives to success, through advisement, the ability to connect or uncover resources, or literally by leading problem solving.

Moreover, when building a team, it is important to understand that you are also building a culture. Paying attention to the kind of board culture you want, and interviewing candidates for attributes as well as skills, will ensure that the board is in full alignment with the needs and values of the organization.

By implementing an intentional process for discerning strengths and gaps on the board, vetting candidates and prioritizing them appropriately, you’ll find not only that your candidates are better suited to the work at hand, but that new members will begin their tenure with clearly-defined roles.

A sample Strategic Needs Table, listing strategic goals and the skill sets needed to execute the strategies involved. Note that contract expertise is useful for more than one goal, meaning that particular skill-set should be a priority.Our foolproof methodology begins with a Strategic Needs Table.

Start by placing your organization’s strategic goals across the top row of a table. Think about the strategies you’ve decided on to reach those goals, and list the skill sets you’ll need to accomplish them beneath.

If your goal is to, say, increase the availability of quality affordable housing, one of your strategies might be to purchase and rehabilitate foreclosed properties, then rent them at an affordable rate. For that, you probably need a number of skill sets: real estate expertise to negotiate deals, banking expertise to assist with financing, an attorney to manage contracts, and a contractor for renovation and maintenance.

As you look across all your goals and strategies, you’re also looking for repeating skill-sets. The need for an attorney, for instance, might arise across a number of goals. Therefore, having an attorney on your board might become a priority position to fill. This person could provide legal advisement, connections to other attorneys, or legal resources and guidance.

Before you can determine the types of board members you need to recruit, you’ve got to understand who on the board already understands the ins and outs of each strategy. To do that, you’ll need to construct a Current Board Inventory.

That means creating another table, this one listing the skill-sets identified by your Strategic Needs Table across the top row, and your current board members down the left-hand column. For each board member, put a check beneath the skill sets they possess. If you don’t yet know your board members well enough to make an accurate inventory—and don’t assume you do—I advise creating a short survey that you can send through email or conduct over the phone. Be sure to ask about current and past employment; significant hobbies; major corporate, philanthropic, or donor relationships; professional association involvement; political positions held; and any other boards served on. You may be surprised!

With your board inventory finished, you should be able to see, at a glance, the strengths your board possesses and the gaps that need filling. That table should allow you to create a prioritized list of skills, talents, and connections you must seek in the next board members you recruit.

You should also take time to decide what you want in your next recruit, because you are creating a board culture as much as you’re seeking skills—and it won’t matter how many strategic needs a particular candidate fills if there’s no cultural fit. If they can’t connect with your organization, chances are they won’t stick around long enough make an impact.

To come up with a list of desired cultural attributes, think about the foundational values of your organization, the work style of your staff and programs, and the qualities you most appreciate in the board members you have. These might include an affinity for improvisation (or for long-term planning); an attitude of positivity and agreeableness (or skepticism and challenge); a certain geographic reach; a kind of diversity (racial, gender, socioeconomic, political); a particular community connection; or the ability to make a personal gift, or to get others to give. (At one nonprofit we work with, the key attribute is “nice.” That’s their code for assertive and positive, rather than contentious or argumentative.)

Once you’ve decided on these key attributes, you can create a Recruit Attributes Chart, much like the Current Board Inventory, accounting for these qualities in the candidates you interview. With that table, you can prioritize recruits who fulfill the same skill-set by their “fit”: that is, how many cultural attributes one marketing expert fulfills compared to the other marketing experts you’re interviewing.

Of course, all of this is just preparation for your real work with the board: empowering your organization to fulfill all the promise of its mission. From here, it’s up to you to develop a purposeful, intentional plan that takes advantage of all the skills and strengths your board members possess.

Access more GCN resources on board building and engagement at GCN.org/Boards.

Karen Beavor is President and CEO of the Georgia Center for Nonprofits. Since 1998, Beavor has led GCN’s growth into a leading state association empowering nonprofits through education, advocacy, research, consulting and business support services. Karen has served as a board member or advisory board member of a variety of civic and nonprofit organizations including the Unemployment Services Trust; National Nonprofit Risk Management Center; and The Foundation Center–Atlanta. Karen has received the Martin Luther King Leadership award and the Harvard Business School Club of Atlanta’s Community Leader Award. She is a member of the 2000 class of Leadership Atlanta and 2003 Coca-Cola Diversity Leadership Academy, and a graduate of Agnes Scott College. About Georgia enter for Nonprofits

The Georgia Center for Nonprofits builds thriving communities by helping nonprofits succeed. Through a powerful mix of advocacy, solutions for nonprofit effectiveness, and insight building tools, GCN provides nonprofits, board members, and donors with the tools they need to strengthen organizations that make a difference on important causes throughout Georgia. Learn more at gcn.org.

For large organizations, or organizations that expect high turnover year-over-year, that number may not be particularly compelling. But for organizations in which high turnover is a sign of a bigger problem, this kind of turnover needs to be looked at as an opportunity for improvement.

Looking more closely at the reasons for separation, nearly 60% of all turnover last year was voluntary. And—including both voluntary and involuntary separation data—about 40% of separations happened when the employee had been in the position less than 6 months.

The cost of turnover can be monumental.

Even for employees that have only recently joined the organization, the cost of replacing them can be mind boggling.

Consider this: the average cost of turnover is typically reported between 15 and 21% of the employee’s salary. But the ‘actual cost’ consists of the time and resources that are spent recruiting and hiring a replacement, greater demands on other employees to pick up the slack (which could lead to burn out and more employee openings), the need to train and develop the new employee, and potentially lost revenue and opportunities.

To stay competitive and to reduce the amount of voluntary turnover as efficiently and effectively as possible, it’s time for employers to dust off their research skills and learn more about what factors are encouraging employees to leave your organization.

Conduct exit interviews, and find out why employees are leaving your organization. Dig deep into the reasons that employees are leaving—is there a toxic employee rotting the rest of their department? Is the amount of work incongruent with the amount of pay? Are poor benefits or strict working hours causing employees to look elsewhere?

Once definitive information has been collected and examined, take the time to address it throughout the organization. Make changes where necessary. And if changes can’t occur, for instance if better benefits are too hard to provide, look for opportunities to become more flexible with employees.

The savings will quickly add up.

Read more about how to see voluntary turnover as an opportunity here.

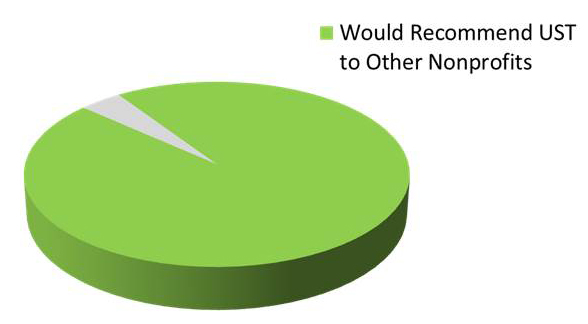

The Unemployment Services Trust (UST) is proud to announce that 96 percent of current participants would recommend the program as a valuable cost-saving opportunity for nonprofits. UST credits the improvement over last year’s 93 percent recommendation rate to an intense focus on the overall member experience and greater attentiveness to members’ needs.

“From the very beginning, the UST program was designed to support nonprofits by reducing the time and cost associated with managing an unemployment claim,” said Donna Groh, Executive Director. “To have found that our members would overwhelmingly recommend our service to other nonprofits is extremely rewarding.”

“We’ve worked hard to improve our customer service model and increase the quality of interactions that our customer service team has with our current members over the past year,” said Adam Thorn, Director of Operations. “By incorporating best practices and higher customer service standards, we have been able to support more in-depth interactions with our members, whether that means providing more detailed responses to questions or better educating organizations about the benefits of reimbursing for unemployment claims versus paying taxes.”

“On the heels of this increase in customer service standards was the increase in direct savings that our members experienced last year as well,” said Groh in reference to mitigated unemployment claims costs and cash back to participants.

Last year, UST was able to help members mitigate $32,598,054 in unemployment claims through best-in-class claims management. The same claims management services allowed UST to return an additional $1.7 million of charges made in error by state unemployment offices, which were audited by UST and credited back to the individual organizations.

Select participants also received $11,041,738 in cash back after their reserve accounts were reviewed for positive claims experience.

How your employees approach their responsibilities and relationships within your organization dictates its level of success. However, how you choose to conduct yourself as a leader sets the tone for your employees’ overarching sense of accountability—which can create either a trusting, or toxic, work environment.

In order to be a great leader, one must educate, coach, empathize, encourage, and sometimes discipline employees. According to Simon Sinek, who was recently featured in TED2014, being a good leader is like being a parent –the main objective is to provide your workers the necessary tools to be successful and grow. Holding your employees accountable for their actions allows them to take ownership of their actions, and forces them to take responsibility for their successes and failures.

For nonprofits, who are often restricted by budgetary concessions, high morale and cooperation are driving forces required for mission advancement. Such internal drive can only be cultivated through feelings of security.

When employees feel as though they are being looked after and respected by their leaders, they develop a greater willingness to take initiative.

Great leaders also sacrifice for the well-being and safety of their staff. Selfless actions from a leadership figure will cause a domino effect of trust within an organization. And when the relationship between employer and employee improves, employees spend more time and energy devoted to strengthening the organization as a whole.

To learn more about what it takes to be a great leader, watch Simon Sinek’s video.

Read more about leadership management tips here.

Her drive and passion to spread awareness within the community makes her a great fit for the UST team. Laurie explains, “I am not doing any volunteer work currently, but when my father passed away from cancer 10 years ago, one of the ways I got through it was to get involved with the American Cancer Society’s Relay for Life fundraisers in Ventura.”

Outside of the office, Laurie and her husband are adjusting to life as newfound puppy parents. They’re rescue puppy, Watson, is a Dachshund/Corgi mix and makes a wonderful addition to their household.

When given the opportunity, Laurie can’t resist the tranquility of nature. “Camping is probably my favorite thing to do and my husband and I go at least twice a year – sometimes more,” she says. “My favorite camping trip was years ago with my sister and some friends and we went on a 50 mile (2 ½ day) river rafting trip on the Colorado River from Grand Junction, CO to Moab, UT…definitely one of the best trips I’ve ever been on!”

In addition to being a dog lover and camping enthusiast, Laurie likes to let loose with a little help from her buddy, Bruce. If her life was a TV show, Laurie would select Growin’ Up by Bruce Springsteen as a theme song that played every time she walked into a room. “This represents the music I grew up with and sometimes I don’t think I’m finished growing up.”

Are you a fan of Bruce Springsteen too? Tell Laurie about it @USTTrust with the hashtag #MeetUSTMondays!

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

Q: Are there any limits on the amount an employer can reimburse employees for mileage before taxes are assessed?

A: The type of reimbursement plan you have will dictate whether reimbursement for business travel is or is not taxable.

With an “accountable plan”, the reimbursement is not taxable to your employee. Amounts paid under an accountable plan are not wages and are not subject to income tax withholding and payment of Social Security, Medicare, and Federal Unemployment (FUTA) Taxes. Your reimbursement or allowance arrangement must meet all three of the following in order to quality as an accountable plan:

The other type of plan that is taxable, subject to all employment taxes and withholding is called a “nonaccountable plan”. Your payments would be considered treated as paid under a nonaccountable plan if: (1) your employee is not required to substantiate expenses to you with receipts or other documentation in a timely manner; and (2) you advance an amount to your employee for business expenses and your employee is not required to and does not return any amount s/he does not use for business expenses in a timely manner.

Please check with your state department of taxation for state tax rules.

For more detailed information on federal mileage reimbursement, please refer to Publication 15, Circular Ehttp://www.irs.gov/pub/irs-pdf/p15.pdf, and Employer’s Tax Guide; Publication 1542, Per Diem Rateshttp://www.irs.gov/pub/irs-pdf/p1542.pdf.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.