The Internal Revenue Service (IRS) has begun its efforts to collect on Affordable Care Act (ACA) penalties by issuing Letter 226J to non-compliant businesses. There’s a chance you may have already received one of these letters.

With only 30 days to dispute the letter, having an action plan in place and ready to go is critical in order to protect your organization from costly penalties that could soar into millions of dollars.

Presented by Equifax, the market leader in ACA management, this on-demand webinar reveals best practices for responding to Letter 226J as well as when and how to submit a dispute. You’ll also gain a better understanding of why you received Letter 226J and how the IRS assessment was calculated.

Ensure your nonprofit is equipped with a plan should IRS Letter 226J arrive in your mailbox and watch the on-demand recording today!

This webinar series is part of UST’s efforts to educate the nonprofit sector. For more learning opportunities, tips and legal updates just for nonprofits, sign up for our monthly e-News today!

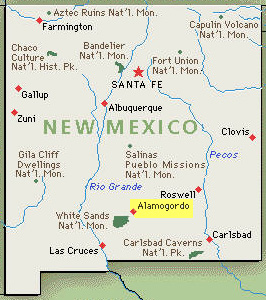

Like many states desperately trying to save their funds from insolvency, legislators in New Mexico passed a bill last year that would have slashed unemployment benefits and hiked the premiums businesses still in the tax-rated state system would have to pay. Martinez, however, eliminated the higher premiums and signed a new bill this year that approved lower rates through 2013.

Senator Gerald Ortiz y Pino (D- Albuquerque) is warning, though, that the state will soon have to borrow from the federal government at a high interest rate because employers only paid $197.8 million into the fund last year. And with more than 40,000 employers drawing from the fund, the remaining $60 million won’t go far.

For nonprofit agencies still in the state system, there are other options, such as leaving the state to join a Trust, like the Unemployment Services Trust (UST), that can help save more money and gain greater predictive control over yearly budgeting.

In fact, New Mexico nonprofits that leave the state system and join UST save an average of $3,483 a year.

To learn more about your opt out alternatives, visit https://www.chooseust.org/501c3-unemployment-alternatives/ or sign up for the an upcoming Exclusive Nonprofit Savings webinar.

Read the full Albuquerque Journal article here.

You’ve already tightened your belt. But now constrained public funding and highly competitive government grants are making sustainability harder than ever for nonprofits, especially those in the human services sector. We think this recent article from the Stanford Social Innovation Review is a great read for nonprofits suffering from funding cutbacks. The article provides guidelines on how to stay afloat during these times, including these five ideas:

1) The importance of strategic clarity and the steps your organization should take to focus on priorities

Nonprofits across the globe offer a wide variety of services. Defining how, where and with whom you have an impact will assist you in finding your niche, and also help you with your funding efforts. From here, nonprofits should define how much it costs to provide each service offered by the organization so you can seek the proper funding needed to keep the program afloat. This allows the agency to locate areas of service that may be altered if funds are lacking and show what areas of the service would benefit the most if funding were increased. Also, focusing on strategic clarity aids the organization in decision making and how you can pursue opportunities for government funding.

2) Diversifying government support streams and how to manage a strapped funding environment

Organizational sustainability is of the utmost importance, so it is imperative that organizations not have all of their funds coming from just one source. Allowing funds to funnel in through multiple sources (government agencies, state programs, donors) can help your organization remain stable amid declining revenues. Nonprofits may consider offering services in different locations or offering their services to others who may benefit from them (for example, offering services for children with behavioral disorders in a school setting, to children with behavioral disorders in foster homes). Organizations can also take contracts that may not cover all of the costs involved with a particular service if there is potential for making up the difference in community support.

3) Improving productivity, efficiency and effectiveness

A notable difference between the for-profit and nonprofit market place is that nonprofit organizations rarely get to name their price when trying to earn a contract. And, since the funds provided don’t always cover the costs required to carryout the work needed, nonprofits find themselves trying to work more efficiently and effectively in order to preserve funds for the future. Many organizations are becoming more tech-savvy and investing in technologies that streamline job processes and free up valuable man hours so they can focus more on “big picture” tasks.

4) Measuring outcomes and utilizing reports to drive internal learning

Many times, nonprofit organizations generate reports to show the results of their efforts to external parties in order to prove they are satisfying funder requirements, government expectations, etc. Measuring outcomes can be a valuable tool in educating internal associates of program productivity and how certain aspects of those programs can be tweaked in order to improve results. Measuring outcomes can also show whether or not a certain program is producing its intended results, ultimately aiding in overall organizational sustainability.

5) Moving beyond “vendorism” and viewing government decision makers as customers

When nonprofit organizations work with government decision makers, keeping in mind that the government is the buyer and the nonprofit is the seller, nonprofits can better position themselves to mold the government’s request for proposals. As Patrick Lawler, CEO of Youth Villages, stated, “We find out where the leadership’s biggest needs and challenges are, and then look at what services we have that can help them solve the problem. We look over every word in new state budgets and the statements made by the governor or head of child welfare services, and put together a plan for how to address the needs identified.”

For you, answering these questions is critical to creating an invested workforce that sparks the creativity and drive that your mission thrives on. Answering the questions also gives employees a sense of who they are and where they fit in your agency, which leads to more productive, and innovative, workdays.

Answering these questions is only part of a strong employee retention policy though. What other steps do you take to keep employees engaged and excited about your nonprofit?

– Interview Available-

Santa Barbara, CA (April 18, 2013) – In an effort to reduce potential penalties for its nonprofit employer members, the Unemployment Services Trust (UST) has launched several new efforts and technological tools to help address what is being called the federal “UI Integrity mandate.”

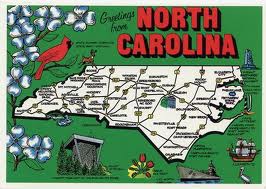

Passed as a part of the Trade Adjustment Assistance Extension Act of 2011, the Unemployment Insurance (UI) Integrity mandate requires all employers to provide a complete and timely response to the state’s first request for information about an unemployment claim. Designed to address one of the biggest weaknesses of Unemployment Insurance (UI) funds nationwide—the persistence of unemployment benefits paid in error, which are have cost $10.3 billion in the last year—the UI Integrity Act requires full compliance from all states no later than October 21, 2013. As of today, 5 states (NE, OK, MS, IL, and WV) have enacted legislation with 6 additional states (CA, UT, NM, SD, MN, and NC) passing legislation to be enacted in the coming months. 12 states (WA, OR, ID, MT, WY, CO, AZ, ND, IA, LA, KY, and VA) have pending legislation. The remaining states have yet to take any action to meet the federal deadline.

To ensure that the reform yields the necessary savings, there will be penalties on employers for non-compliance. Any employer that fails to provide a complete and timely response to a claim loses any hope of relief from charges attributable to that claim—even if the employer ultimately wins the claim.

Further, if the state identifies a pattern of failure to provide complete and timely responses, negligent organizations and their claims administrator are at risk of permanently losing valuable protest rights and/or facing monetary penalties.

To address these new liabilities, the Unemployment Services Trust (UST), which helps more than 2,000 nonprofit employers nationwide to reduce the cost of unemployment claims, is conducting regional seminars and state-specific webinars for its members. Through its partnership with Equifax Workforce Solutions (WS), UST’s educational opportunities will allow its nonprofit members to examine how changes to the national UI integrity laws will affect them and to gather helpful tips to improve overall win ratios when protesting improper claims. On average, this type of diligence reduces an employer’s claims costs by 15% each year.

In addition to the seminars and webinars, UST’s nonprofit members now have access to a unique unemployment claim dashboard called CaseBuilder, which was launched by WS earlier this year. “This online dashboard will allow organizations to gather and submit documents and details in a fast, secure environment for all stages of the unemployment process,” reports Workforce Solutions. Current members who utilize CaseBuilder have significantly increased their ability to comply with state requests in a timely manner—which will be extremely pertinent as states begin to integrate UI Integrity legislation into their practices.

Finally, members of UST are already reaping the benefits of “SIDES,” the State Information Data Exchange System that 24 states have implemented, with more scheduled throughout 2013. SIDES is a secure, paperless system which allows UST members and their claims administrator WS to better provide necessary details and documentation at the time of an initial claim filing. Here is how it is helping UST member organizations:

“All employers will be on the hook to respond to every unemployment claim, every time,” says Donna Groh, Executive Director of UST. “We’re trying to establish best practices that ensure our member nonprofits are ahead of the curve—so they can avoid penalties down the road.”

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing 501(c)(3) organizations with a safe, cost-effective alternative to paying state unemployment taxes. Equifax Workforce Solutions (WS) is UST’s partner to provide members with claim administration, audits of state charges, and hearing representation if a member’s claims protest goes to court. They also provide educational seminars and training materials to UST member agencies throughout the year. Visit www.ChooseUST.org to learn more.

For nonprofits, this isn’t the worst of the news.

After falling below 9 percent in April for the first time in more than 3 years, the rate has begun a steady climb upward again, negatively affecting nonprofit employers throughout Georgia by simultaneously increasing cost and need. Compounded by the state’s depleted unemployment insurance trust fund and an outstanding loan balance of more than $742 million that is still owed to the federal government, nonprofits are facing a higher possibility increased unemployment taxes in 2013.

Because Georgia quickly depleted its unemployment insurance (UI) trust fund, the struggle to provide benefits has hurt employers and jobless workers as the state has made large cuts to benefits and steeply increased the overall unemployment costs paid by employers.

Further adding to the coming financial strain, the interest on the federal unemployment trust fund loan cannot be paid from the unemployment tax fund and must instead be paid from other state revenues, causing further financial stress for legislators.

To pay it, the Georgia legislature passed SB 347 earlier this year, which, in addition to cutting jobless benefits and increasing unemployment benefits paid out by employers, includes provisions to:

While this legislation makes Georgia one of 11 states that have cut jobless benefits in the past year by reducing the duration and level of payouts and by restricting eligibility, the legislation may ultimately harm nonprofits specifically as it forces unemployed workers to turn to nonprofits for aid, while also increasing the amount that agencies must set aside to pay for unemployment costs of their own.

For nonprofit organizations still in the state tax system, there are other options available though. Since 1972 nonprofit employers have had the exclusive ability to opt out of the state system and reimburse directly the dollar-for-dollar costs of only their own unemployment costs.

By safely leaving the state’s pooled liability system and paying only for their own unemployment costs, many nonprofits- particularly those with 10 or more employees- can save up to 50 percent off of their UI taxes and gain greater predictive control over yearly budgeting. In fact, Georgia nonprofits that leave the state system and join UST save an average of $14,321 a year.

Learn more about your nonprofits money saving alternatives, or sign up for an upcoming webinar to learn how UST can help your nonprofit reduce SUI costs.

The system is far from perfect though.

For instance, the system is intrinsically flawed for many nonprofit employers who face little to no job-turnover and who remain a part of their state system. Featured in a recent report, the North Carolina UI system has provided one of the strongest examples of why eligible 501(c)(3)’s should consider opting out of their state UI system, as allowed by federal law.

After borrowing more than $2.4 billion from the federal government to meet their UI responsibilities after their UI Trust Fund became insolvent during the Great Recession, North Carolina has begun leveraging their high interest payments on state UI participants.

Like many states which were unable to meet their UI obligations, the burden of reimbursing the federal government for the full loans falls on all employers within the state, whether or not any of their former employees are currently collecting unemployment benefits.

No state reached insolvency overnight though.

Long before the recent recession, states resisted “indexing” or raising their unemployment taxes from year to year. Things were good, the economy was stable — why should they make adjustments? But while employers enjoyed low taxes, in the long run they were being set up for a much bigger fall in the future. And that’s when the Great Recession hit. Not only had states failed to maintain an adequate UI cushion, employers would be double-hit by the recession in having to lay off workers to cut costs, and then pay higher unemployment taxes as a result. According to a 2010 Government Accountability Office report, “Long-standing UI tax policies and practices in many states over 3 decades have eroded trust fund reserves, leaving states in a weak position prior to the recent recession.” Not that states weren’t warned. Even in North Carolina, the Budget and Tax Center reports that it “conducted a thorough analysis of the unemployment insurance system in March 2007, before the start of the Great Recession, warning of the long-term unsustainability of the system as implemented and suggesting reforms.”

More than ever, systems today must be built that can better weather economic downturns and large, prolonged layoffs. Adequate funding levels must be re-attained so that states rely less on the federal government for funding support to meet benefit payments. A system must also be built which maintains its ability to support the economy with wage-replacement levels that are adequate in supporting workers seeking work.

While innovative programs must continue to be introduced to help place jobseekers in new positions, an overhaul of many state UI systems would better support nonprofit employers who remain in their state tax-rated UI system whether they are too small to opt out, or if they feel safer in the state system.

However, because 501(c)(3)s have the exclusive right to opt out of their state UI system in favor of becoming a reimbursing employer that pays directly for former employees’ UI costs, many already experience a greater savings because they aren’t paying for the state’s interest on federal loans, or subsidizing larger employers’ UI costs.

UST releases a new eBook, focused on helping nonprofit organizations create a workforce to stand apart in a competitive job market.

Founded by nonprofits for nonprofits, UST publishes an eBook that reveals the latest best practices that can help nonprofits find and retain employees that fit their organization’s culture, mission and values. This resourceful eBook provides ideal strategies nonprofits can utilize when tackling a competitive market and juggling the many organizational challenges that comes with maintaining a dynamic workforce.

The eBook, “Competitive Hiring Practices That Empower Nonprofits,” reveals that “56 percent believe their current job is only a temporary stepping stone to something better.” However, with the right tools in place nonprofits will be able to offer their employee’s professional development while creating a nurturing base where talented people can grow, feel challenged and valued.

“Hiring the best-fit personnel can be demanding of your time, energy and resources”, explains Donna Groh, Executive Director of UST. “This eBook offers the critical tools organizations need to draw in and maintain best-fit professionals that can help carry out mission-driven initiatives.”

With recent survey data and nonprofit employment trends, UST is able to provide nonprofits with six proven strategies to develop and maintain a thriving workforce.

The eBook, now available for free download, also offers:

Be sure to download your complimentary copy today!

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

But many nonprofits put relationships with employees at a lower level of importance than relationships with donors and other funding sources. Ultimately this common mistake undermines the entire organization and detracts from your mission because it creates a counterproductive work environment.

To begin fixing these botched relationships, and celebrating your employees for who they are and what they do, we’ve put together the top 3 things NOT TO DO.

1. Playing favorites: We all know you have favorite employees. Whether they’re your top performers, best friends, or just people you really like for the job, don’t treat them any differently than you treat the rest of your employees.

Better yet, treat the rest of your employees the same way you treat your favorites.

2. Not giving employees a forum for voicing suggestions: If you want employees to know that they’re valued members of your organization encourage them to make suggestions to improve your operations or the way that their job is handled.

More importantly, take the time to recognize and implement the best suggestions. This will motivate employees to improve working processes and implement new activities.

3. Lack of communication with employees: Open and easy communication helps build the strongest relationships within your agency.

However you accomplish it, make sure that you’re present and easy to get in touch with when employees want, or need, to talk.

Connect with us on Facebook, on Twitter @USTTrust, or on LinkedIn and tell us what other things you would add to the list.