As a nonprofit leader, you have an obligation to approach “harassment” with three key factors in mind— prevention, investigation and willingness to address. Investigations of harassment in the workplace can come in many shapes and sizes, meaning they can originate from a wide variety of topics—such as discrimination, substance abuse, harassment or workplace safety. While each investigation can be different and may have different formalities attached to it—standards should be in place to ensure a thorough investigation is applied to each incident.

It is important to respond immediately when an allegation of harassment surfaces. This can help prevent any new acts from taking place and will help with maintaining the trust of your employees. At the same point, you should be reaching out for professional guidance to ensure that all aspects of a harassment claim is carried out appropriately—reaching out to your insurance carrier to provide a “notice of a potential claim.” This is a common move for nonprofits since the insurance company can offer resources and the expertise of legal counsel. Another option is hiring a third-party human resource firm that has experience with handling harassment investigations. Lastly, a nonprofit may decide to handle the investigation in house utilizing its’ own staff with guidance from various legal resources.

Each investigation should be handled promptly, documented, thorough and remain confidential. Your nonprofit should always aim for consistency and consider how to best provide “due process.” This also includes, informing those involved with the outcome of the investigation once it has concluded. Being transparent about the outcome, actions or steps being taken to address a situation, will give your nonprofit the opportunity to demonstrate follow through of its own policies, while remaining confidential and maintaining privacy for those involved.

As a nonprofit, you are required to maintain the safety of your employees by creating a safe working environment—and with that comes the responsibility of acting promptly when approached with a harassment claim. Whether it’s the CEO or an associate being investigated, it should be carried out in the same manner and properly conducted. This will determine that the appropriate policies are in place and encourage fair outcomes for all employees involved.

Employers added 157,000 jobs in July and the unemployment rate went down to 3.9 percent making the number of unemployed people decline by 284,000. At the end of July, the total number of people unemployed is now at $6.3 million.

In July, the number of long-term unemployed was unchanged at 1.4 million, which accounts for 22.7 percent of the unemployed. In addition, the number of persons employed part time for economic reasons—also referred to as involuntary part-time workers—changed slightly in July, at 4.6 million, but has been down by 669,000 over the course of the year. These individuals, who would have preferred full-time employment, were working part time because of their hours being reduced or they were unable to find full-time jobs.

America increased employment in professional and business services, manufacturing, health care and social assistance sectors. In professional and business services, there was an increase of 51,000 jobs in July making an overall increase of 518,000 over the course of the year. In the manufacturing sector, there was 37,000 jobs added with most of the gain in durable goods. There was a rise in transportation equipment (+13,000), machinery (+6,000) and electronic instruments (+2,000). Over the past 12 months, manufacturing has added 327,000 jobs in total. Lastly, employment in health care and social assistance rose by 34,000 and with an upward trend of +17,000 jobs in health care employment this past month, the number of jobs has totaled 286,000 since the beginning of the year. Hospitals and social assistance added 23,000 jobs during the month of July.

The average hourly earnings for all employees on private nonfarm payrolls rose by 7 cents to $27.05. Over the year, average hourly earnings have increased by 71 cents, or 2.7 percent. Average hourly earnings of private-sector production and nonsupervisory employees increased by 3 cents to $22.65 in July.

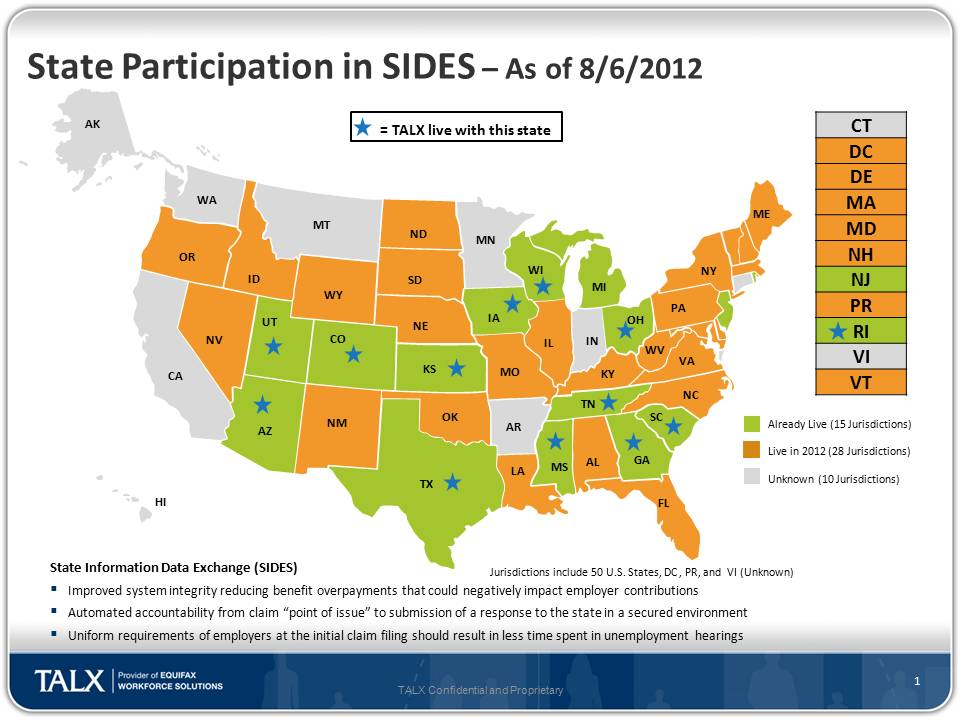

Each year, the establishment survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. The Bureau of Labor Statistics (BLS) will release this preliminary estimate of the upcoming annual benchmark revision on August 22 at 10am.

Are you frequently overwhelmed by your workload and flustered by the chaos that your desk has turned out? You’re not alone. Many of us feel buried every now and then – it’s your busiest time of year, there’s new mail, invoices and or reports that end up on your desk every day and before you know it your desk looks like a tornado swept through it. The problem isn’t so much that your desk is messy but that important stuff gets lost. Beyond efficiency, the strain of disorganization can add unnecessary stress to your work day and cause mental exhaustion.

Reason dictates that those who are unorganized cannot be as efficient or as productive as those who are. There are some however, that know exactly where everything is. Some people may feel that a cluttered desk makes they appear busier while others feel a clean desk shows how efficient they are at getting the work done. Either way, the key is to work in a manner that allows you to be the most effective.

Whether you want a white glove worthy desk or just to bring some order to your work area, utilizing these simple tricks will get you on track in no time at all.

If you are like most of us, you are going to spend the majority of your day at work. It’s essential to your organization and sanity to make your work space work for you so that it maximizes your efficiency.

UST is giving 532 nonprofits $3,869,249 in cash back for their ability to reduce their anticpiated unemployment claims within the year.

UST, a program dedicated to providing nonprofits with workforce solutions that help reduce costs so that they can focus more on their missions, announces that it will be dispersing $3,869,249.80 in cash back to more than 532 of their program participants. After accruing all of their claims savings, audited state returns and cash back throughout the last year, UST members will have $30.1 million filtered back into their nonprofits’ pockets.

UST aims to provide 501(c)(3) nonprofits with the latest HR training, outplacement resources and unemployment claims management tools they need to stay compliant with the state and federal laws, while also helping to reduce paperwork burdens.

One of UST’s most popular programs, UST Trust, helps reimbursing employers build a reserve—protecting their money on the front end—so they don’t experience the steep ups and downs in their cash flow due to unexpected unemployment claims. Unlike their for-profit counterparts, UST Trust participants can receive cash back through UST when their organization is able to reduce their unemployment claims and still maintain a healthy reserve balance for future claims.

“The $3.8 million we are returning to UST participants can offer their organizations the flexibility they need to execute additional mission-driven initiatives,” said Donna Groh, Executive Director of UST. “Here at UST, we are pleased to be able to continue returning funds to our members and further supporting the communities in which they serve.”

These refunds are just part of how UST serves its mission of “Providing nonprofits with workforce solutions that reduce costs and strengthen their missions.”

To learn more about the UST program for 501(c)(3) employers, visit www.ChooseUST.org. If you’re a reimbursing or tax-rated nonprofit, and looking for innovative ways to save money, fill out a free Unemployment Cost Analysis form.

Things seem to be changing though. Recently economic-focused news outlets, like Bloomberg Businessweek, have been reporting an upswing in hiring trends, lower jobless claims and that companies are re-hiring for many of the positions they previously cut.

Creating hope that the recession may be breathing its last breaths, these reports are also changing the ways employees interact at nonprofits.

Now, even though more people are volunteering with charitable and nonprofit agencies through social media and word-of-mouth, the lack of funding for employee paychecks is causing high turnovers as these employees are offered better paying jobs elsewhere.

For instance, The Chronicle of Philanthropy has found that there is an exceptionally high turnover rate for fundraisers that is costing charities lots- and lots- of money. Finding that most fundraisers are only staying at their jobs for an average of 16 months and are being recruited after only a few months, the direct and indirect costs of finding a replacement are estimated to be $127,650 per fundraiser.

Because demand for fundraisers, and many other nonprofit employees, vastly outstrips the supply of good candidates, the president of Cygnus Applied Research, Penelope Burk, says that she has found that “only 1 out of 3 fundraisers experience[s] even a day without a job.”

In conducting research for a study that is expected to be released this fall, Burk suggests that keeping fundraisers happy can save organizations thousands of dollars. She also suggests that agencies work at promoting their internal talent and offering training opportunities that can make inside people better qualified for assuming new positions.

Just one example of where high turnover is hurting nonprofits, the move to re-train the unemployed for new positions is also affecting nonprofits as many job seekers are requesting courses and training in fields like computers and nursing where they can expect a stable salary.

Operating on already tight budgets, the high rate of turnover at many nonprofits is making it even harder to survive, but by looking for ways to increase employee happiness- whether that means offering more time out of the office or the ability to work from home- more agencies can compete for the best possible candidates.

To find out if job seekers can be re-trained to work for your organization, contact your local unemployment agency or career center.

Cutting employees’ hours may seem like an easy way to reduce costs, but if you didn’t think employees could collect unemployment for that, you might be in for a (not-so-good) surprise.

It seems like a simple way to avoid having to lay good employees off, and over the past few years many employers have turned to this popular alternative. While not necessarily ideal, for many organizations reducing employees’ hours has been a more palatable option and has allowed them to keep their best workers on staff.

But what many employers don’t realize right away is that reducing hours may not yield the anticipated savings.

Why?

When an employer reduces an employee’s hours as a result of the organization’s needs, the employee could be eligible to collect partial unemployment benefits for the loss in wages. And the state will include this in the chargeback liability attributed to the organization.

If you think reducing hours is still a quick and easy way to cut costs without laying anyone off, consider this. An employee is still eligible to collect partial unemployment benefits when:

That’s why it’s incredibly important for nonprofit employers to carefully weigh the consequences of reducing hours, laying off employees, and/or using contractors before making any decisions about staffing changes. Often surprise charges can crop up when changes are made, so you will want to know what effect the unemployment claim charges may have on your organization’s benefit claims.

If you want to discuss how different staffing changes could affect your claims experience, you may want to look into membership in the Unemployment Services Trust (UST). 501(c)(3)s with 10 or more employees can find out if they qualify for membership, and receive the help of UST’s expert claims administrator to determine the impact of all staffing changes before actions are taken. It’s been proven that using an unemployment claim administrator helps save an average 15% annually on costs! Call a UST expert at 1-888-249-4788 to learn more about membership.

Tip 1: Document Everything.

Effective documentation is absolutely crucial to reducing your unemployment costs because, as the employer, you will often carry the “burden of proof” with the state.

Although good documentation can also help in matters related to the EEOC and employment litigation, documentation for discharges and voluntary quit situations is different. Namely you want to be extremely careful of the language you use in documenting a voluntary separation or discharge because the state has specific legal definitions of terms such as “unsatisfactory” work. And you will want to be careful that you are protesting claims that do not constitute good cause in a voluntary quit. These could include quits to attend school, get married, change careers, staying at home with children, or job abandonment.

Also, make sure that your organization is keeping good records. Whenever you provide policies and documentation to employees, be sure to obtain a signed acknowledgement of policies and changes to policies, and keep the receipt for at least 18 months.

Customer loyalty is a given no matter what type of business you’re running and for nonprofits who need loyal donors to survive and flourish, how you nurture your donor relationships can make or break your business.

Remember donors don’t just stop giving. They just stop giving to you. More so than your typical customer, donors want to know that their business is appreciated—let’s face it they’re not buying materials from you that can be used in their day-to-day life— they’re giving away their hard-earned cash. Never assume that they will continue investing in your cause—even if it is something they deeply believe in—if they don’t feel appreciated or at minimum acknowledged. Whether you’re talking about an online donation of $30, a married couple that donates $200 or a Fortune 500 company that gives millions, it’s your responsibility to make sure they know that their donation is making a difference in your work.

Human beings are hard-wired for connecting with others. Even when we don’t try, we can’t help but to seek relationships and form bonds. Donors want to see, feel, and experience the impact their gifts have on your organization so they believe that their continued support will keep making a difference.

Always consider the person behind the donation and not just the donation itself. Some strategies nonprofits can use to create dynamic donor acknowledgment and retention programs are:

To maintain an engaged donor base and a high retention rate year-over-year, focus your attention on donors over donations. The people giving to your organization are more important and when donors invest, it creates a bond between them and your nonprofit—keep building on that with a comprehensive relationship building program.

Infographic: A due date nears on unemployment trust fund loans

by Carla Uriona and Mary Mahling at Stateline.org

View the story at http://stateline.org/live/details/story?contentId=597982

“Later this month, states will have to make the first interest payment on the money they borrowed from the federal government to keep sending unemployment checks to workers who’ve lost their jobs. Some 28 states have outstanding loans with the federal government. According to a May estimate by Federal Funds Information for States, the total interest due by September 30 is $1.3 billion. The federal stimulus package had provided interest-free loans to states, but that grace period has expired. Earlier this year, President Obama asked Congress to waive those interest payments for another two years, but the idea went nowhere. The proposal could resurface when Congress returns this month and takes up the president’s jobs package.”

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

In this day and age, the reference check has become much more than a mere formality. Shedding light on what a candidate is really like, calling references and verifying former positions and educational history helps enlighten the hiring team as to what the best, and sometimes worst, parts of working with a particular candidate are.

Underestimating the amount of information you can glean from conducting reference checks is done all too often though. Because it takes significant time and energy to call every reference, it might be easier for some agencies to look at having a third party professional recruiter talk to the references.

If this isn’t a strong option, the key to conducting the most successful reference checks lies in asking, and listening, to carefully developed questions that speak to what you most want, and need, to learn about a candidate. Making the process feel like a conversation- one where you’re up front and open about what the opportunity is and what information you’re looking to learn about the candidate- can lead to valuable revelations that help cement your decision and show you where you can best support and develop a new hire.

When developing your reference check questions, you should look for both hard data, such as questions about the candidates skill set, and qualitative data which will help you better understand the candidate’s communication and management style as well as their strengths and areas for improvement.

Some sample questions might include:

Speaking with a broad list of references- personal, professional, and developmental- will help you put together the best possible picture of what a candidate would look like in your organization. Since few candidates will put down anyone that would give a less-than-stellar review of them and their abilities, drill down deep into how the reference talks about the candidate and their level of enthusiasm about your candidate for the most telling information.

Thankfully, after all of the reference checks are done, if the candidate still matches your expectations, you can finally make your offer.

Read more about checking candidates’ references.