By exercising their exclusive nonprofit tax alternative, as allowed by Federal law, 501c3 organizations participating with UST have the ability to pay only for their own unemployment claims, which can save them thousands annually. Because they are no longer subsidizing for-profit companies in the state tax system, and are receiving expert claims guidance, UST members can efficiently manage their unemployment claims while mitigating liability.

“Within the last three years, UST has identified over $16 million in potential unemployment claims savings for hundreds of nonprofits across the United States,” said Donna Groh, Executive Director of UST. “It’s incredibly rewarding to know that the UST program continues to provide financial relief to such hard-working nonprofits and the communities they serve.”

In addition to offering claims support, UST also help nonprofits cut costs further by helping organization streamline their workforce and avoid costly legal fees with robust HR resources built into its program. These expert tools, including the live HR hotline, online job description builder and award-winning outplacement services, provide UST participants the extra bandwidth they need to strengthen their missions.

As the largest, lowest-cost trust nationwide, UST helps 501c3 organizations save valuable time and money through a host of workforce management solutions that include – unemployment claims management, cash flow protection, certified HR assistance, outplacement services and more. With the ability to find hidden savings for both tax-rated and direct reimbursing employers, UST encourages nonprofits with 10 or more employees to benchmark their costs.

The Unemployment Services Trust (UST) is pleased to announce its new affinity partnership with the District of Columbia Behavioral Health Association. The D.C. Behavioral Health Association has chosen to pair up with UST to help their member organizations reduce unemployment costs and direct more funds toward mission advancement objectives.

This new partnership will allow 501(c)(3) organizations with 10 or more employees in the D.C. community to better take advantage of the federal law that allows nonprofits to opt out of the state unemployment tax system. By paying only the dollar-for-dollar cost of unemployment benefits paid to former employees, nonprofit employers that join UST lower their average claims cost to just $2,287 per claim versus the national average of $5,174 per claim.

“Nonprofits are often faced with smaller budgets and limited resources,” said Donna Groh, Executive Director of UST. “But last year, UST helped members achieve over $32.5 million in unemployment claims savings. We are thrilled to have the D.C. Behavioral Health Association join us as our latest Affinity Partner and look forward to helping their members maintain HR best practices and lower their unemployment costs.”

About D.C. Behavioral Health Association: D.C. Behavioral Health Association aims to expand and improve community-based behavioral health services through policy advocacy and staff development. All 42 members offer extensive services to the D.C. housing supports for adults and children in foster care, including treatments for substance abuse and mental health. For more information, visit www.dcbehavioralhealth.org.

About UST: The Unemployment Services Trust is dedicated to educating 501(c)(3)s about controlling HR and unemployment costs and helping them exercise their federal right to reimburse for unemployment claims, dollar-for-dollar. UST helps nonprofits manage unemployment claims to successfully save thousands of dollars annually. Learn more at www.ChooseUST.org.

Unfortunately, for many states, the realization came a little too late.

During the height of the Recession, almost 40 states borrowed a combined $50 billion from the Federal Unemployment Trust Administration (FUTA) to continue providing jobless benefits. This much debt required many states to make long-term changes to their unemployment systems by either charging penalties or fees to businesses or by cutting jobless benefits. Many made historic cuts to the number of weeks of aid available, but some—like New Jersey which racked up more than $1.5 billion in debt—took a long, hard look at the administration of their trust.

In New Jersey that long, hard look at the administration of their unemployment trust fund resulted in some spectacular results. Over the past four years New Jersey has identified more than 300,000 people who tried to wrongly collect benefits through identity theft, failure to report a new job, schemes, and honest mistakes. Also:

But what did New Jersey do that set them on the path to successfully rebuild their unemployment trust fund?

They updated their system.

Namely, they began using a strategy referred to as ‘identity proofing.’ With the help of LexisNexis, the state of New Jersey requires applicants to verify a wide range of personal information through a quiz on the state labor department’s website. The questions are specifically developed to be ones that the individual who owns an identity could accurately answer.

Then, using the billions of public records that LexisNexis collects, the answers—which range from what kind of car an applicant has, to who lives at their address—help weed out potential frauds.

Less than a year-and-a-half into the effort, more than $4.4 million in improper payments have already been stopped, and almost 650 instances of identity theft have been avoided.

Want to know how well your state is catching improper payments? The U.S. Department of Labor provides this state-by-state breakdown for 2013.

Read more about how New Jersey is fighting improper payments and unemployment fraud here.

The Department of Labor (DOL) provides a short overview of the program on their website, and summarizes it by saying: “Unemployment Insurance is a federal-state program jointly financed through Federal and state employer payroll taxes. Generally, employers must pay both state and Federal unemployment taxes…However, some state laws differ from the Federal law and employers should contact their state workforce organizations to learn the exact requirements.”

The program itself works to provide jobless workers who have lost their job through no fault of their own with temporary, partial wages while they search for a new position. For more information on how unemployment insurance works, read our more complete overview on the state program.

Is Your Nonprofit Liable?

501(c)(3) nonprofits are exempt from federal unemployment taxes, but may be liable for state contributions if they meet something called the “4 for 20″ provision. This provision is triggered when four or more individuals are employed on the same day for 20 weeks in a calendar year, though not necessarily for consecutive weeks. It is important to note that who is considered “employed” for these purposes is not always straightforward – see Independent Contractors below.

Why Independent Contractors May Still Be Considered Employees

There are different rules and tests used by government organizations to determine independent contractor status, because different organizations are responsible for separate aspects of law. For the purposes of unemployment insurance, the Department of Labor uses something called the “ABC test”, which makes it sound simple, but is more complicated when applied to real situations.

The ABC Test establishes criteria that an work relationship must meet in order to for the services of that individual to not be considered employment. The three parts of the ABC Test relate to employer control/direction of the worker, place(s) of business or courses of business, and proof that the worker is independently established in the trade. A nonprofit may have to pay unemployment taxes even if the IRS or their state revenue services determine that, for income tax purposes, individuals may be independent contractors.

Cost-Saving Alternatives

The Unemployment Services Trust (UST) provides an alternative to paying into the state unemployment tax system, and can be a cost-saving option for nonprofits with more than 10 employees. Through UST, organizations directly reimburse the state only for the claims of their former employees, rather than paying the state unemployment insurance tax which covers all employers throughout the states.

And, because keeping unemployment costs low is vital to so many organizations across the U.S., we’ve added state-by-state information for taxable wage bases from the Department of Labor so you can see where your organization falls on the tax scale.

We encourage nonprofits to be proactive in learning what their options are, and what types of unemployment tax alternatives best suit their needs. Complete a complimentary Savings Evaluation to see if your organization could save money on its unemployment costs.

This post does not constitute official or legal advice. A version of this article originally appeared on blog.nonprofitmaine.org by Molly O’Connell.

Over the next several weeks 521 nonprofit members of the Unemployment Services Trust (UST) will receive a combined $8,762,873 in cash back. In total this brings participant savings over the past year to more than $43 million in claims savings, audited state returns, and cash back.

“One of the most exciting times of the year at UST is when we get to tell members that they will be receiving money back,” said Donna Groh, Executive Director of UST. “For members that elect to take the cash back as a check this money often helps them expand important initiatives. And, learning the exact impact that each dollar we’re able to save, and return, to nonprofit employers helps motivate us to find even more ways to lower unemployment costs across the board for our members.”

The UST program, which helps nonprofits with 10 or more employees control unemployment-related HR costs, includes an annual review of its 2,000+ nonprofit accounts–using an advanced actuarial model. Unlike the state unemployment tax system or some private insurance where taxes and premiums cannot be refunded (even when benefits paid out are far below what the employer paid in), UST instead allows for cash back when an organization has a positive unemployment claim experience.

UST members whose claims were lower than anticipated, and that are well-funded for future claims, will receive a direct refund or credit to their nonprofit organization.

“Hearing the individual stories about what members plan to do with their cash back is extremely rewarding, and allows us to better emphasize the mission-driven impact of becoming part of the UST program,” seconded Adam Thorn, Director of Operations.

By aiming to ensure that a nonprofit is properly reserved for unemployment claims costs, but not holding excess funds beyond the necessary cushion for future claims, UST helps serve its mission of “Saving money for nonprofits in order to advance their missions.”

To learn more about the UST program for 501(c)(3) employers, visit www.ChooseUST.org or call (888) 249-4788 to speak with an Unemployment Cost Advisor.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

This newest partnership will allow U.S. based organizations with a 501(c)(3) tax designation to more effectively take advantage of the federal law that allows nonprofits to opt out of the state unemployment tax system. By paying only the dollar-for-dollar cost of unemployment benefits paid to former employees, organizations that join UST lower their average claims cost to just $2,287 per claim versus the national average of $5,174 per claim.

“The ultimate goal of each and every nonprofit association that we work with is to provide their members with the best opportunities to advance their missions. By combining the power of hundreds, and sometimes even thousands, of smaller nonprofits, associations are able to get better money saving tools customized for their members,” said Donna Groh, Executive Director of UST.

“Last year we found more than $3.5 million in tax savings for nonprofits that came to us through our association partnerships. This year we want to double that and find at least $7 million in tax savings for our affinity partners’ member organizations.”

About the Alliance for Children and Families: The Alliance is a national organization dedicated to achieving a vision of a healthy society and strong communities for all children, adults, and families. The Alliance works for transformational change by representing and supporting its network of hundreds of nonprofit human serving organizations across North America as they translate knowledge into best practices that improve their communities. Working with and through its member network on leadership and advocacy, the Alliance strives to achieve high impact by reducing the number of people living in poverty; increasing the number of people with opportunities to live healthy lives; and increasing the number of people with access to educational and employment success. For more information, visit Alliance1.org. About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

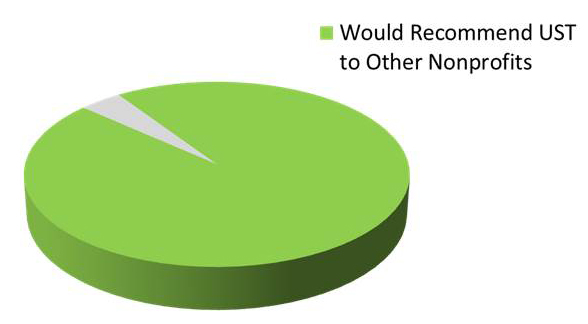

The Unemployment Services Trust (UST) is proud to announce that 96 percent of current participants would recommend the program as a valuable cost-saving opportunity for nonprofits. UST credits the improvement over last year’s 93 percent recommendation rate to an intense focus on the overall member experience and greater attentiveness to members’ needs.

“From the very beginning, the UST program was designed to support nonprofits by reducing the time and cost associated with managing an unemployment claim,” said Donna Groh, Executive Director. “To have found that our members would overwhelmingly recommend our service to other nonprofits is extremely rewarding.”

“We’ve worked hard to improve our customer service model and increase the quality of interactions that our customer service team has with our current members over the past year,” said Adam Thorn, Director of Operations. “By incorporating best practices and higher customer service standards, we have been able to support more in-depth interactions with our members, whether that means providing more detailed responses to questions or better educating organizations about the benefits of reimbursing for unemployment claims versus paying taxes.”

“On the heels of this increase in customer service standards was the increase in direct savings that our members experienced last year as well,” said Groh in reference to mitigated unemployment claims costs and cash back to participants.

Last year, UST was able to help members mitigate $32,598,054 in unemployment claims through best-in-class claims management. The same claims management services allowed UST to return an additional $1.7 million of charges made in error by state unemployment offices, which were audited by UST and credited back to the individual organizations.

Select participants also received $11,041,738 in cash back after their reserve accounts were reviewed for positive claims experience.

Her drive and passion to spread awareness within the community makes her a great fit for the UST team. Laurie explains, “I am not doing any volunteer work currently, but when my father passed away from cancer 10 years ago, one of the ways I got through it was to get involved with the American Cancer Society’s Relay for Life fundraisers in Ventura.”

Outside of the office, Laurie and her husband are adjusting to life as newfound puppy parents. They’re rescue puppy, Watson, is a Dachshund/Corgi mix and makes a wonderful addition to their household.

When given the opportunity, Laurie can’t resist the tranquility of nature. “Camping is probably my favorite thing to do and my husband and I go at least twice a year – sometimes more,” she says. “My favorite camping trip was years ago with my sister and some friends and we went on a 50 mile (2 ½ day) river rafting trip on the Colorado River from Grand Junction, CO to Moab, UT…definitely one of the best trips I’ve ever been on!”

In addition to being a dog lover and camping enthusiast, Laurie likes to let loose with a little help from her buddy, Bruce. If her life was a TV show, Laurie would select Growin’ Up by Bruce Springsteen as a theme song that played every time she walked into a room. “This represents the music I grew up with and sometimes I don’t think I’m finished growing up.”

Are you a fan of Bruce Springsteen too? Tell Laurie about it @USTTrust with the hashtag #MeetUSTMondays!

Since the Great Recession took its initial toll on the state unemployment insurance (UI) funds, states across the U.S. have gone into considerable debt in order to provide benefits for millions of unemployed. Trying to combat unemployment costs while restoring their debt with the federal government, many states look towards alternative measures to repair their financial foundations.

In 2011, states accumulated a debt of over $47 billion owed to the federal government– the peak of the United States’ economic deficit. While the federal debt has since decreased, with 16 states still owing over $21 billion at the beginning of 2014, a lot of states took out private loans to avoid an automatic increase in their federal unemployment tax on employers.

With a low UI trust fund balance, many states have been forced to cut their unemployment benefits, rather than borrowing additional money from the government. Other alternative methods used to reach state solvency include:

Such actions were meant to diminish volatility and recover sensibly from the impact of the debt.

While the states have steadily reduced the debts triggered by the Great Recession, the U.S. has a long way to go before they achieve full economic restoration. And employers will continue to see their overall cost of unemployment steadily rising, if their state is to both recover and prepare for the next downturn.

To see how your state unemployment insurance trust fund debt compares to other states, view Stateline’s chart here.

Learn more about how the U.S. is affected by the unemployment trust fund debt here.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

The UST HR Workplace powered by ThinkHR empowers nonprofit HR professionals with the guidance they need to be more effective and efficient in their jobs. By providing expert HR advice, thousands of HR templates, hundreds of training courses and an award-winning online library for all workplace concerns, the UST HR Workplace gives nonprofits the knowledge they need to avoid costly risks and liability issues.

“Maintaining risks in the workplace is crucial to any organization but specifically for the nonprofit sector where one unexpected risk can put the organization in a situation they’re unprepared for,” said Donna Groh, Executive Director of UST, “ThinkHR helps nonprofit HR professionals avoid costly litigation with the tools available to them through use of ThinkHR Live, Comply and Learn.”

Staying on top of the latest HR laws and educating employees on organizational policies can help mitigate volatile unemployment claims and reduce costs long-term. Last year alone, UST members took nearly 5,000 online training courses and submitted close to 1,500 HR questions. The most popular resources utilized included Workplace Safety and Harassment Prevention training, Compliance and compensation inquiries, the Employee Handbook Builder and downloadable HR forms.

The UST HR Workplace has been a go-to resource for UST’s participating nonprofit employers since its launch in 2014 and is a priceless support system that helps to save time and money – offered at no additional cost to UST members.

Nonprofits can get a free 30-day trial of the UST HR Workplace powered by ThinkHR by visiting https://www.chooseust.org/thinkhr/.

About UST https://www.chooseust.org/thinkhr/ Founded in 1983, the Unemployment Services Trust UST provides 501c3s with a cost-effective alternative to paying state unemployment taxes. UST participants save millions annually through claims management, hearing representation, claim audits, outplacement services and HR support. Join more than 2,200 nonprofits nationwide and request an Unemployment Cost Analysis at www.ChooseUST.org.