A: The employer should contact the Employee Assistance Program (EAP) directly and request a review of the process for making referrals. In general, during the implementation process, the EAP provides the contracting employer with that information so that employees and employers have a clear understanding of the services the EAP can offer employees and the process by which the employer can make referrals to the service. This service typically includes employer assistance so that employers may communicate directly with the EAP counselor to provide a “heads up” to the counselor regarding the performance issue and obtain guidance for handling the discussion with the employee. Then the employer can have the performance discussion and refer the employee to the EAP as part of the action plan for performance improvement. Discussions between the employee and the EAP are confidential, and the employer should not expect feedback from the EAP regarding those discussions.

While the employer can make the referral, it is ultimately an employee’s choice whether or not to contact and work with the EAP. If the employee chooses not to seek help or address the issue that led to the referral in the first place and performance does not improve, then the employer should follow its progressive disciplinary process, including corrective action up to and including termination of employment.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

Sometimes it’s sudden, like an accident or health crisis, and other times it’s simply a short term window to prepare for a leader leaving—but it is always important to have a backup plan when it comes to a leader’s absence.

It’s called emergency succession planning, and it’s critical to your organization’s survival.

Like any good emergency plan (think of those fire drills as a kid in school) – there should be clearly laid out steps to your emergency succession plan. Ready to stop, drop, and roll? Here are some basic elements to any good leader succession plan:

Learn more about emergency succession planning in this report.

Here are a few ways you can maintain an ethical culture at work:

Because nonprofits are often small organizations working in a small sector, their reputations are precious. Creating and implementing a strong ethical culture where employees maintain integrity will improve internal morale and help the overall business grow.

Learn more about how to encourage strong ethics within a work environment here.

Here at UST, we believe hiring the right employees is one of the top ways to reduce your organization’s overall unemployment costs. That’s why we’re committed to this blog, and giving nonprofits the tools they need to reduce turnover, reduce costs, and reduce time spent managing them! We also want to make sure nonprofits aren’t overpaying for unemployment taxes. You can find out by filling out a (free) savings evaluation here.

Even your strongest staff members can be negatively influenced when working with bad employees. Pairing others with someone who is unmotivated and performing inadequately can cause a domino effect of poor performance—making the overall business suffer.

Poor employees could chase away top performers

Top tier employees want to work with others who are just as driven and focused as they are. When talented workers see poor behavior or lack of contribution go unnoticed, they will begin looking for alternative job opportunities—ones where they can work with other high performers and feel more appreciated.

Low performers take up valuable space

By keeping low performing employees, you could be missing out on a new crop of talent. But how can you hire these rockstar candidates if there are no available roles at your organization? Making room for strong individuals who are willing to take initiative and contribute to the team is imperative when building a strong organizational foundation.

Because nonprofits often work with limited budgets and resources, developing and retaining a top-notch staff is key to successfully attaining mission objectives. And while it’s never an easy task to fire a bad employee, you’re doing what’s necessary as a leader to keep your organization moving forward.

Learn more about talent development strategies here.

A: Unless there is an employment contract or collective-bargaining agreement that suggests otherwise, employers do have the ability to set an employee’s work hours and job duties based on business needs. In the situation you described, you have a poor performer whom you want to transfer to another position, enhance the job, and bring in another employee to do the work. We assume that you have been addressing the current incumbent’s poor performance issues and the job that you are moving the employee into will be more in line with his or her skills and hopefully provide an opportunity for the employee to be more successful on the job. If you have not addressed your performance concerns, now is the time to do so. Explain why the change is necessary and use the opportunity to discuss the employee’s career goals and development needs. It is critical that the employee receive feedback regarding performance and behavior, as this may continue into either role and should be addressed to correct the concerns or take progressive discipline as appropriate. Have these conversations before you announce the new employee transferring into the expanded position.

The employee may have questions regarding why you are taking a part-time position and turning it into a full-time one and may suggest that he or she could be successful in the job if allowed the additional time each day to complete the duties. Be prepared to address that and provide the employee with a copy of the expanded job duties and explain why he or she is not the right fit for that job. Having a direct and respectful conversation, with specific feedback and action plans to move forward, can go a long way to making the change successful.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

Follow these 6 simple methods to ensure a successful employee transition:

Taking the time to efficiently train your new employees on your nonprofit’s culture, strategic goals, and personal role expectations will not only help new hires adjust, but also strengthen your organization as a whole.

Learn more tips about how to manage new employees here.

A: Yes. You may wish to inquire as to what types of compensation information they need so that you are providing the detail and data that is relevant for their review and discussion. You will want to ensure the privacy of your employees’ personal information, such as concealing Social Security numbers, garnishments, etc.

Executives typically need relevant summary compensation information for decision-making with revenue and cost considerations. Reviewing the actual intent of how the data will be used may enable you to provide a summary report without revealing data that could potentially be perceived as inappropriate to reveal.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

This is the longest it’s taken in more than a decade, 13 years to be exact, says the Vacancy Duration Measure. Compared to the height of the Great Recession, that’s actually almost 10 days longer than it took to fill a job then, when it was at 15.3 working days, reports TLNT.

Why the lag in recruiting and hiring for organizations across the U.S.?

Recruiters say that candidates are driving the employment market as opposed to the organizations– being more picky about the positions they will accept and the compensation and benefits they are willing to take. When turning down an offer, top candidates say the reason is another offer. And employers that are slow to make an offer are losing out and having to start all over with their search.

Increasing turnover a factor

Turnover, as we’ve all seen in the nonprofit world, is also an ever-growing trend. While unemployment subsides, many qualified employees are more comfortable jumping from job to job (or from the nonprofit sector to the private sector). Voluntary separations are on the rise according to the DOL, which reported 2.7 million people quit their jobs in June.

And a larger number of vacant positions is putting a strain on organizations, which are in a more pressured state of recruitment than in years past. Now, when hiring, filling the position isn’t enough. To avoid more future turnover, organizations are having to look at employee engagement and job satisfaction with a closer eye. Succession planning is also critical to ensuring the organization can stay afloat when key employees leave or retire.

Employee training may be key

While candidates may feel more confident in their hireability and be more choosey, it’s also true that employers are being more selective as well—sometimes too much. The gap between an unqualified and a qualified candidate can sometimes be filled through on-the-job training. Looking for the right personal traits and attributes in a potential employee is more important than specific job knowledge for many positions. And finding the right person for the job, not just the right resume, can mean long-lasting job satisfaction and less turnover.

Answer: More than likely the frequent use of a restroom may be a serious health condition; however, one would look to the Americans with Disabilities Act (ADA) prior to counting this time against the Family and Medical Leave Act (FMLA) entitlement.

In general, when counting bathroom time against an employee’s FMLA entitlement, only do so if the frequency and duration extends beyond the employee’s normal lunch and break periods.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

A: This answer is based upon the fact that there is no specific employment contract in place that outlines specific reasons for termination of employment and that the employer has an employment-at-will policy in place that provides for termination at will based upon the employer’s discretion.

From the detailed description of the situation, this employer does have an internal disciplinary procedure in place that specifies termination of employment for performance. This error was made years ago and could have been detected if the employee had been conducting annual audits of the file, which was not done, compounding the error.

Although employers can terminate employment “at will”, there should always be a legitimate business reason for the termination that is well documented, nondiscriminatory and carefully considered in order to reduce the employer risk of liability from wrongful termination suits.

The employer should consider the following prior to making the final decision:

If the employer believes that the situation warrants termination of employment because it is well-documented, the employee has been properly trained, the supervision was adequate, and that this is a unique situation, then a termination is allowed, but we recommend confirming the decision with legal counsel prior to the termination.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

But slow down just a minute. Are you sure your organization is ready to hire more employees?

Although only your organization can determine if you’re actually ready to hire new employees, Inc. recommends answering the following questions about your organization, where you want it to go, and what is happening now.

What kind of organizational structure do you want?

Do you want your organization to grow extensively? Are you pretty happy with the size it is now, but unable to meet the demands of your mission with your current staff, or are you hoping to grow organically whenever the need arises?

Will you be able to slow down growth if you need to?

Not all organizations have significant control over how much growth they will experience in any given time. For instance, if your organization helps provide disaster relief to a specific area and the area suddenly experiences a large-scale disaster, your response must be immediate and decisive. Or, if your organization helps animals and takes part in a multi-county animal seizure, you must be able to provide shelter and care for all of the animals involved for the foreseeable future.

But if your organization works to help a select group of impoverished students succeed, it’s reasonable to expect that there will not be an unmanageable influx of students to your program in any given year.

Do you really need help?

Do any of your employees have extra time throughout their week or month that can be used to address some of the needs that you’d like to hire new employees for? If so, can these employees be trained to perform some of the needed tasks?

While it might not fully address your needs, it would cut down on organizational waste and potentially allow for a part-time position to be created in lieu of the more expensive full-time position.

Are you fully prepared to recruit, hire, and train more employees?

Our ThinkHR resources and your UST Customer Service Representative can help you ensure your organization is best positioned to do all three without exposing you to excess liability in the future.

Not yet a member? Learn more about the UST program here.

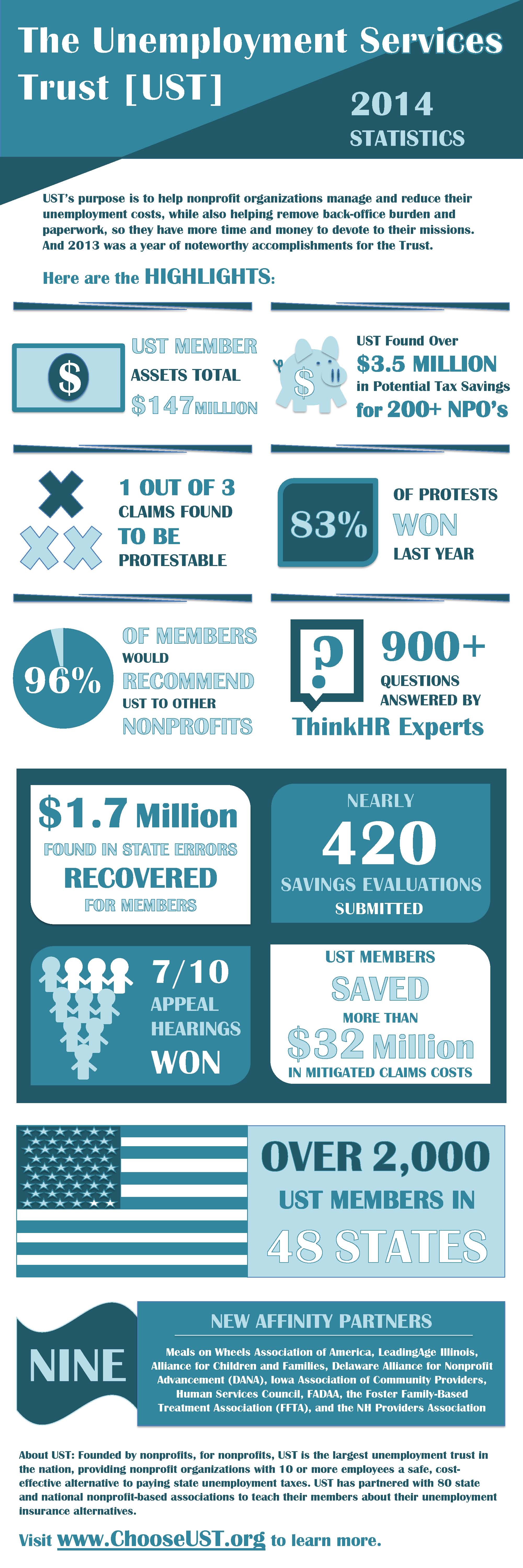

By offering access to an expert HR hotline, over 200 employee training courses, and a dedicated claims representative, UST helped its members uphold HR best practices, while remaining compliant with state laws. Last year, UST members saved more than $32 million in mitigated claims costs and won over 80% of their claims protests.

With a 96% recommendation rate, UST’s membership base and overall impact within the nonprofit sector continues to grow. Check out the full infographic for the full list of last year’s noteworthy accomplishments:

For a limited time, you can download the whitepaper for free and find out:

Learn the secrets of other nonprofit executives and HR staff who have reduced their human resource and unemployment claims costs. Download your complimentary copy of 5 Myths That Are Increasing Your Nonprofit’s HR Costs today.

By providing exclusive access to such cost saving resources, UST aims to educate 501(c)(3) organizations on the latest HR best practices and compliance laws—living up to its mission of “Saving money for nonprofits in order to advance their missions.”

Fill out a complimentary Savings Evaluation to find out if you can save with UST.

Q: Is there a reason to have a supervisor’s name in an offer letter? In other words, is an offer letter that only lists a new hire’s supervisor as a title acceptable?

A: There is no definite reason to have a supervisor’s name on an offer letter or any requirement to have the title on the document either.

The intent of the offer letter is to welcome the new hire and to ensure that the new hire has all of the information s/he will need regarding the terms and conditions of employment. If, in your environment, putting the supervisor’s name on the document does not make sense, then feel free to leave it off the document.

We do recommend, however, that you do include a contact person that the new employee can go to for questions about the position or for any assistance the new employee may need.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

But how do you find the right employee? Simple. Recruit a hiring team internally before recruiting any potential staff.

The hiring team you assemble should be your recruitment backbone—helping you create the hiring timeline, outline specific role responsibilities, and conduct interviews.

Here are 6 tips to keep in mind when creating and working with your recruitment team:

Having the support of a dedicated hiring team can help speed up the hiring process, while increasing efficiency. Knowing when and how to engage your hiring staff can help you identify the best possible candidate for any potential position—giving your nonprofit the edge it needs accomplish mission objectives.

Learn more about how to select and utilize your recruitment team here.

A: Unless your business handles public safety concerns, we would encourage you to very carefully consider implementing mandatory retirement age policies, and certainly NOT to do it on a case-by-case basis.

The reason is that on a federal level, company wide mandatory retirement age policies violate the Age Discrimination in Employment Act (ADEA), except in limited circumstances. The ADEA, which applies to organizations with 20 or more employees, protects employees age 40 and older from discrimination based on their age. Prior to 1986 the age discrimination law did not protect employees over the age of 70 in the workplace, but due to the 1986 amendment to the Act, this age cap was removed. As a result, all employees over 40 years old generally are covered by the ADEA. Since this change, companies are no longer able to enforce a mandatory retirement age for all employees.

There is one exception under the ADEA (outside of bona fide reasons for retirement, such as public safety officers, etc). That exception is company executives in a bona fide executive or higher policy-making position. For example, federal law does allow mandatory retirement for a company CEO at age 65 or older under two conditions:

If the reason you are asking the question is because you are concerned with how you deal with the growing number of older workers and the potential for declining performance in old age, the government expects us not to assume that all employees of a certain age are unable to perform their jobs or will be less productive for the organization.

But if an older worker is not performing at the level of expectation, this is a performance issue that should be addressed in accordance with your company’s policies and practices as a performance issue, not an age issue. (And this should be done on a case-by-case basis).

Allow the employee the opportunity to improve through training and coaching; do not assume the older employee will not or cannot learn and adapt to change.

The way many employers are helping their older workers while making room for their younger employees is through the use of voluntary retirement programs. These programs offer all employees of a certain age within the organization a retirement package above and beyond other guaranteed retirement benefits. Voluntary retirement packages do not violate the ADEA because they provide an option (not a mandate) for the older worker to receive more (not fewer) benefits upon retirement than someone retiring or leaving the company at a younger age.

We would encourage you to work with your legal counsel to discuss other relevant regulations and requirements of voluntary retirement programs.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

mentation of a more civil society. Those elected for the honor “illustrates the power of people pushing society for equal access and opportunity…[as] recently it seems that the insistence for inclusion has need ratcheting up and sector leaders have responded.”

mentation of a more civil society. Those elected for the honor “illustrates the power of people pushing society for equal access and opportunity…[as] recently it seems that the insistence for inclusion has need ratcheting up and sector leaders have responded.”

Everyone at UST wou

ld like to extend our heartfelt congratulations to those included. We’d also like to thank all of the organizations that we work with for continuing to fight the good fight and make a difference for those around them.

See the full list of innovators being recognized by this years’ Power & Influence Top 50 here.

Unfortunately, for many states, the realization came a little too late.

During the height of the Recession, almost 40 states borrowed a combined $50 billion from the Federal Unemployment Trust Administration (FUTA) to continue providing jobless benefits. This much debt required many states to make long-term changes to their unemployment systems by either charging penalties or fees to businesses or by cutting jobless benefits. Many made historic cuts to the number of weeks of aid available, but some—like New Jersey which racked up more than $1.5 billion in debt—took a long, hard look at the administration of their trust.

In New Jersey that long, hard look at the administration of their unemployment trust fund resulted in some spectacular results. Over the past four years New Jersey has identified more than 300,000 people who tried to wrongly collect benefits through identity theft, failure to report a new job, schemes, and honest mistakes. Also:

But what did New Jersey do that set them on the path to successfully rebuild their unemployment trust fund?

They updated their system.

Namely, they began using a strategy referred to as ‘identity proofing.’ With the help of LexisNexis, the state of New Jersey requires applicants to verify a wide range of personal information through a quiz on the state labor department’s website. The questions are specifically developed to be ones that the individual who owns an identity could accurately answer.

Then, using the billions of public records that LexisNexis collects, the answers—which range from what kind of car an applicant has, to who lives at their address—help weed out potential frauds.

Less than a year-and-a-half into the effort, more than $4.4 million in improper payments have already been stopped, and almost 650 instances of identity theft have been avoided.

Want to know how well your state is catching improper payments? The U.S. Department of Labor provides this state-by-state breakdown for 2013.

Read more about how New Jersey is fighting improper payments and unemployment fraud here.

A: In order to reduce the risk of being held personally liable under either a federal or state statute, it is important for HR processionals to:

In order to understand and identify potential risks, HR professionals should have a good grasp of applicable employment law, along with an understanding of their business and the ability to maintain an ethical approach. Additionally, it is critical that HR professionals feel comfortable pushing back on the company when appropriate and vocalizing when something is not right, either legally or from a company values or culture perspective.

Federal Liability

Some of the areas where an HR professional may have exposure to personal liability are:

State Liability

HR professionals may have exposure to liability under a number of state or common law statutes ranging from assault, defamation, intentional infliction of emotional distress, ignored harassment or discrimination, and more.

It is not unusual for a disgruntled employee suing an employer to seek individual liability in order to increase their chances of a settlement. Most liability insurance policies don’t cover employment law violations so it is not unusual for companies to add additional employment practice liability insurance (EPLI) to address these situations. You should determine whether your employer has such a policy and if your position and self are protected under stated company plans.

The best way for HR professionals to avoid personal liability is to:

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

Follow these 5 easy steps to create sustainable changes within your nonprofit:

Change is what keeps nonprofits moving forward. Taking the time to foster cooperation amongst your employees is the easiest way to create lasting change—which provides ongoing opportunity for organizational growth within the nonprofit sector.

Learn more about how to gain employee support for organizational change here.

The Department of Labor (DOL) provides a short overview of the program on their website, and summarizes it by saying: “Unemployment Insurance is a federal-state program jointly financed through Federal and state employer payroll taxes. Generally, employers must pay both state and Federal unemployment taxes…However, some state laws differ from the Federal law and employers should contact their state workforce organizations to learn the exact requirements.”

The program itself works to provide jobless workers who have lost their job through no fault of their own with temporary, partial wages while they search for a new position. For more information on how unemployment insurance works, read our more complete overview on the state program.

Is Your Nonprofit Liable?

501(c)(3) nonprofits are exempt from federal unemployment taxes, but may be liable for state contributions if they meet something called the “4 for 20″ provision. This provision is triggered when four or more individuals are employed on the same day for 20 weeks in a calendar year, though not necessarily for consecutive weeks. It is important to note that who is considered “employed” for these purposes is not always straightforward – see Independent Contractors below.

Why Independent Contractors May Still Be Considered Employees

There are different rules and tests used by government organizations to determine independent contractor status, because different organizations are responsible for separate aspects of law. For the purposes of unemployment insurance, the Department of Labor uses something called the “ABC test”, which makes it sound simple, but is more complicated when applied to real situations.

The ABC Test establishes criteria that an work relationship must meet in order to for the services of that individual to not be considered employment. The three parts of the ABC Test relate to employer control/direction of the worker, place(s) of business or courses of business, and proof that the worker is independently established in the trade. A nonprofit may have to pay unemployment taxes even if the IRS or their state revenue services determine that, for income tax purposes, individuals may be independent contractors.

Cost-Saving Alternatives

The Unemployment Services Trust (UST) provides an alternative to paying into the state unemployment tax system, and can be a cost-saving option for nonprofits with more than 10 employees. Through UST, organizations directly reimburse the state only for the claims of their former employees, rather than paying the state unemployment insurance tax which covers all employers throughout the states.

And, because keeping unemployment costs low is vital to so many organizations across the U.S., we’ve added state-by-state information for taxable wage bases from the Department of Labor so you can see where your organization falls on the tax scale.

We encourage nonprofits to be proactive in learning what their options are, and what types of unemployment tax alternatives best suit their needs. Complete a complimentary Savings Evaluation to see if your organization could save money on its unemployment costs.

This post does not constitute official or legal advice. A version of this article originally appeared on blog.nonprofitmaine.org by Molly O’Connell.

A: If the employee in question has not done anything illegal or against company policy in the workplace, the employer is not required to take any action. However, the concern may be that the workplace may become a charged environment between these two employees.

The employer should monitor the environment at work, focusing on job performance and productivity, while remaining aware of the possibility of existing conflict between the two employees that may create a hostile environment or a distraction for those working nearby.

If either individual creates a conflict in the workplace, the employer should address it immediately and counsel the offender. Written documentation of any event should occur.

An employee whose behavior is questionable outside of the workplace may not be disciplined or singled out by the employer. However, the employer has the responsibility to ensure that no employee is subjected to a hostile work environment and will want to be aware of any conflict amongst the individuals. Additionally, no action should occur until such time as an employee is convicted of any alleged complaint, nor should any perceived act of retaliation exist.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

Taking the time to plan out one’s budget, on a more consistent basis, can help an organization better identify, prioritize, and build towards their goals. To create an effective budget, follow these 6 simple steps:

In order to grow within the nonprofit sector, organizations must learn how to construct and abide by their determined budgets. Serving as a roadmap to achieving annual objectives, a well thought out budget can help nonprofits succeed without sacrificing excess funds.

Learn more about the importance of nonprofit budget planning here.

A: A “hostile work environment” is one of the two types of sexual harassment prohibited by law. The scope of this type of harassment is broad, but is generally defined by the following examples provided by the Department of Labor:

A hostile environment can result from the unwelcome conduct of supervisors, co-workers, customers, contractors, or anyone else with whom the individual interacts on the job, and the unwelcome conduct renders the workplace atmosphere intimidating, hostile, or offensive.

Examples of behaviors that may contribute to an unlawful hostile environment include:

The Department of Labor provides more information on when a hostile work environment violates the law and suggested information for creating a policy here.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

The speaker then asked the participants to perform the search again as a collaborative group. He suggested they each pick up one balloon and find the owner of that balloon.

If you haven’t already heard about the study findings, which recently began to go viral, all of the participants were sitting down, with their unique balloon, well before the 5 minute mark.

For the past couple of decades, researchers have been performing live social experiments like this one to illustrate the power of teamwork and collaborative effort. Out of this body of work has come some pretty powerful information that can improve your organization—and it’s collaborative results—if used well.

Not least among the information sets that have been discovered, is the fact that companies that have the best collaborative teams are 10 times more likely to reach high financial goals as those who don’t. So what is it that makes the best teams?

According to MIT researchers, the best teams:

If you’re team is not performing as well as you would like them to, or if your team is fairly homogenous—which researchers have repeatedly found discourages a healthy level of creativity— this article from the Society of Human Resources Management (SHRM) suggests appointing someone within your team to play devil’s advocate.

Other suggestions to improve the collaborative working environment within your team include:

A: The answers to your questions are ultimately determined by company policy due to the fact that there is no mandatory requirement under state or federal laws to offer employees holiday pay. Many employers do, however, offer holiday pay to both full- time and part-time employees as part of the company’s competitive total compensation package.

It is a matter of company policy regarding pay for a holiday that falls within the week of an employee’s vacation. You may define eligibility criteria for these benefits, such as requiring that employees work the day before and the day after the holiday to receive the benefit unless on approved time off, or holiday pay will only be provided when the holiday falls on a regularly-scheduled work day.

Nothing under the federal or state family and medical leave laws (FMLA or state “mini-FMLA”) require an employer to continue a holiday pay benefit during an unpaid leave for either hourly non-exempt or exempt employees.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

On July 9th the Unemployment Services Trust (UST) released its first ever animated video short. As a part of UST’s ongoing efforts to educate nonprofits about the cost-saving alternative exclusively available to those with a 501(c)(3) tax status, the video will be shared with thousands of nonprofits.

About a minute long, the video reveals how more than 2,000 nonprofit employers with 10 or more employees have saved up to 60% on unemployment costs and reduced time spent on HR after joining the UST program.

By developing a highly focused repertoire of services—including an expert HR Hotline and Resource Library, and an expert claims management system with a secure online claims dashboard—UST helped members save $32,598,054 in mitigated unemployment claims last year.

Last month an additional $8,762,873 was returned, in cash, to participants that had an overall positive unemployment claims experience in 2013. Altogether this represents more than $43 million in claims savings, audited state returns, and cash back for members last year.

To learn more about the UST program for 501(c)(3) employers, visit www.ChooseUST.org or call (888) 249-4788 to speak with an Unemployment Cost Advisor.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

Over the next several weeks 521 nonprofit members of the Unemployment Services Trust (UST) will receive a combined $8,762,873 in cash back. In total this brings participant savings over the past year to more than $43 million in claims savings, audited state returns, and cash back.

“One of the most exciting times of the year at UST is when we get to tell members that they will be receiving money back,” said Donna Groh, Executive Director of UST. “For members that elect to take the cash back as a check this money often helps them expand important initiatives. And, learning the exact impact that each dollar we’re able to save, and return, to nonprofit employers helps motivate us to find even more ways to lower unemployment costs across the board for our members.”

The UST program, which helps nonprofits with 10 or more employees control unemployment-related HR costs, includes an annual review of its 2,000+ nonprofit accounts–using an advanced actuarial model. Unlike the state unemployment tax system or some private insurance where taxes and premiums cannot be refunded (even when benefits paid out are far below what the employer paid in), UST instead allows for cash back when an organization has a positive unemployment claim experience.

UST members whose claims were lower than anticipated, and that are well-funded for future claims, will receive a direct refund or credit to their nonprofit organization.

“Hearing the individual stories about what members plan to do with their cash back is extremely rewarding, and allows us to better emphasize the mission-driven impact of becoming part of the UST program,” seconded Adam Thorn, Director of Operations.

By aiming to ensure that a nonprofit is properly reserved for unemployment claims costs, but not holding excess funds beyond the necessary cushion for future claims, UST helps serve its mission of “Saving money for nonprofits in order to advance their missions.”

To learn more about the UST program for 501(c)(3) employers, visit www.ChooseUST.org or call (888) 249-4788 to speak with an Unemployment Cost Advisor.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

But finding and hiring highly engaged employees is difficult. You might ask – How can an employee be “engaged” before they’re even hired? Well, the highly engaged employee is often a person who simply leans in that direction in all parts of their life. That’s why finding them is so important for your nonprofit – because it’s easier to help an engaged employee thrive than to try to build one from the ground up.

Here are some signs of a motivated personality when you’re looking at hiring, or even internal development:

1. They don’t expect their organization or their leaders to provide all the stimulation in their workday or their job. They seek out new opportunities to engage in their job on their own. Complaining about a former manager or job not providing enough work satisfaction in an interview can be a red flag that they didn’t take that extra step to engage themselves at their previous job.

2. They know their performance speaks for itself, and they’re not worried about what their organization can give them, but rather about what they can give to their organization. They have a low sense of entitlement. (Although rewarding and recognizing them is important to keeping them engaged!)

3. They help inspire others to love your mission, including clients and volunteers. They can’t help but be excited about what they’re doing and that translates to others.

4. They are engaged despite the conditions around them. Even if their last job wasn’t perfect, they found ways to be engaged. And even motivation in other places of their life can show an “engaged” personality – like running a 5k to help a local dog shelter. Your job is simply to foster this engagement at work.

5. They enjoy shaping their own outcomes – and the outcomes of your organization. Being a voice in the direction of your organization, whether it’s something small like finding a better way to file invoices, or more strategic like new ideas for an annual campaign, they will feel happiest when they can give something to your organization.

6. They like to stretch the limits. This can be uncomfortable for leaders, but allowing engaged employees to think outside of the box can lead to some amazing results. And sometimes listening and showing you are truly interested in their input, even if it doesn’t get used in the end, shows that this behavior is not only welcome, it’s appreciated – and it should be!