Taking the time to plan out one’s budget, on a more consistent basis, can help an organization better identify, prioritize, and build towards their goals. To create an effective budget, follow these 6 simple steps:

In order to grow within the nonprofit sector, organizations must learn how to construct and abide by their determined budgets. Serving as a roadmap to achieving annual objectives, a well thought out budget can help nonprofits succeed without sacrificing excess funds.

Learn more about the importance of nonprofit budget planning here.

A: A “hostile work environment” is one of the two types of sexual harassment prohibited by law. The scope of this type of harassment is broad, but is generally defined by the following examples provided by the Department of Labor:

A hostile environment can result from the unwelcome conduct of supervisors, co-workers, customers, contractors, or anyone else with whom the individual interacts on the job, and the unwelcome conduct renders the workplace atmosphere intimidating, hostile, or offensive.

Examples of behaviors that may contribute to an unlawful hostile environment include:

The Department of Labor provides more information on when a hostile work environment violates the law and suggested information for creating a policy here.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

The speaker then asked the participants to perform the search again as a collaborative group. He suggested they each pick up one balloon and find the owner of that balloon.

If you haven’t already heard about the study findings, which recently began to go viral, all of the participants were sitting down, with their unique balloon, well before the 5 minute mark.

For the past couple of decades, researchers have been performing live social experiments like this one to illustrate the power of teamwork and collaborative effort. Out of this body of work has come some pretty powerful information that can improve your organization—and it’s collaborative results—if used well.

Not least among the information sets that have been discovered, is the fact that companies that have the best collaborative teams are 10 times more likely to reach high financial goals as those who don’t. So what is it that makes the best teams?

According to MIT researchers, the best teams:

If you’re team is not performing as well as you would like them to, or if your team is fairly homogenous—which researchers have repeatedly found discourages a healthy level of creativity— this article from the Society of Human Resources Management (SHRM) suggests appointing someone within your team to play devil’s advocate.

Other suggestions to improve the collaborative working environment within your team include:

A: The answers to your questions are ultimately determined by company policy due to the fact that there is no mandatory requirement under state or federal laws to offer employees holiday pay. Many employers do, however, offer holiday pay to both full- time and part-time employees as part of the company’s competitive total compensation package.

It is a matter of company policy regarding pay for a holiday that falls within the week of an employee’s vacation. You may define eligibility criteria for these benefits, such as requiring that employees work the day before and the day after the holiday to receive the benefit unless on approved time off, or holiday pay will only be provided when the holiday falls on a regularly-scheduled work day.

Nothing under the federal or state family and medical leave laws (FMLA or state “mini-FMLA”) require an employer to continue a holiday pay benefit during an unpaid leave for either hourly non-exempt or exempt employees.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

On July 9th the Unemployment Services Trust (UST) released its first ever animated video short. As a part of UST’s ongoing efforts to educate nonprofits about the cost-saving alternative exclusively available to those with a 501(c)(3) tax status, the video will be shared with thousands of nonprofits.

About a minute long, the video reveals how more than 2,000 nonprofit employers with 10 or more employees have saved up to 60% on unemployment costs and reduced time spent on HR after joining the UST program.

By developing a highly focused repertoire of services—including an expert HR Hotline and Resource Library, and an expert claims management system with a secure online claims dashboard—UST helped members save $32,598,054 in mitigated unemployment claims last year.

Last month an additional $8,762,873 was returned, in cash, to participants that had an overall positive unemployment claims experience in 2013. Altogether this represents more than $43 million in claims savings, audited state returns, and cash back for members last year.

To learn more about the UST program for 501(c)(3) employers, visit www.ChooseUST.org or call (888) 249-4788 to speak with an Unemployment Cost Advisor.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

Over the next several weeks 521 nonprofit members of the Unemployment Services Trust (UST) will receive a combined $8,762,873 in cash back. In total this brings participant savings over the past year to more than $43 million in claims savings, audited state returns, and cash back.

“One of the most exciting times of the year at UST is when we get to tell members that they will be receiving money back,” said Donna Groh, Executive Director of UST. “For members that elect to take the cash back as a check this money often helps them expand important initiatives. And, learning the exact impact that each dollar we’re able to save, and return, to nonprofit employers helps motivate us to find even more ways to lower unemployment costs across the board for our members.”

The UST program, which helps nonprofits with 10 or more employees control unemployment-related HR costs, includes an annual review of its 2,000+ nonprofit accounts–using an advanced actuarial model. Unlike the state unemployment tax system or some private insurance where taxes and premiums cannot be refunded (even when benefits paid out are far below what the employer paid in), UST instead allows for cash back when an organization has a positive unemployment claim experience.

UST members whose claims were lower than anticipated, and that are well-funded for future claims, will receive a direct refund or credit to their nonprofit organization.

“Hearing the individual stories about what members plan to do with their cash back is extremely rewarding, and allows us to better emphasize the mission-driven impact of becoming part of the UST program,” seconded Adam Thorn, Director of Operations.

By aiming to ensure that a nonprofit is properly reserved for unemployment claims costs, but not holding excess funds beyond the necessary cushion for future claims, UST helps serve its mission of “Saving money for nonprofits in order to advance their missions.”

To learn more about the UST program for 501(c)(3) employers, visit www.ChooseUST.org or call (888) 249-4788 to speak with an Unemployment Cost Advisor.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

XpertHR and Nonprofit HR conducted a 2014 survey of Senior HR professionals to reveal the way nonprofit HR departments are constructed and held accountable. Representing 260 organizations throughout the US and Canada, the results showcase the importance of measuring and documenting an HR department’s effectiveness.

According to the survey, just over 1/3 of organizations reported documenting an official HR strategy. And with nearly 40% of HR professionals failing to measure their department’s effectiveness, many nonprofits have trouble building upon their HR best practices.

In addition to sustaining an effective HR department, nonprofits are also burdened by a limited HR budget. Taking the cost of HR salaries, recruitment, and administration into account, the median cost of running an HR department is reported at $91,715.

In order to alleviate financial HR costs, UST offers its members exclusive access to ThinkHR, a value added service that provides HR professionals with expert advice and support tools. This service includes a live HR Hotline, an online HR library, and over 200 employee training courses. Learning how to outsource and prioritize your organization’s HR needs can save you money—money that can be put towards mission advancement and further HR staff development.

Learn more about how your nonprofit can gain access to ThinkHR’s expert HR staff here.

Despite the pressure to constantly face their imminent demise, the smartest nonprofits—the ones that are best positioned to make a long-term impact on their mission—carefully build and manage a healthy operating fund, as well as an ample operating reserve fund. By protecting their organizational finances against sudden or dramatic cash flow changes, these organizations can continue to provide services in the toughest times.

Having a healthy operating budget provides your nonprofit with a more solid base by setting aside unrestricted net asset balances and investing them in the organization’s programs. The greater this reserve, the greater your organization’s ability to grow current programs and promote your mission.

The operating reserve portion—the portion set aside for emergencies and unforeseen circumstances that negatively affect your financial operations—protects your employees and your mission in the direst of circumstances.

Unfortunately, there isn’t one set benchmark for how much money a healthy nonprofit should have set aside as an operating reserve budget.

The Importance of Operating Reserves for Nonprofits- Read the article here.

Nonprofit Operating Reserves and Policy Examples- Visit the webpage here.

Maintaining Nonprofit Operating Reserves- Download the whitepaper here.

Reserves Planning: A step-by-step approach for nonprofit organizations- Download the whitepaper here.

Budgeting “Best Practice” Tips for Nonprofits- Download the PDF here.

Financial Management- Visit the National Council of Nonprofits financial management resource list here.

A: The type of reimbursement plan you have will dictate whether reimbursement for business travel is or is not taxable.

With an “accountable plan”, the reimbursement is not taxable to your employee. Amounts paid under an accountable plan are not wages and are not subject to income tax withholding and payment of Social Security, Medicare, and Federal Unemployment (FUTA) Taxes. Your reimbursement or allowance arrangement must meet all three of the following in order to quality as an accountable plan:

The other type of plan that is taxable, subject to all employment taxes and withholding is called a “nonaccountable plan”. Your payments would be considered treated as paid under a nonaccountable plan if: (1) your employee is not required to substantiate expenses to you with receipts or other documentation in a timely manner; and (2) you advance an amount to your employee for business expenses and your employee is not required to and does not return any amount s/he does not use for business expenses in a timely manner.

Please check with your state department of taxation for state tax rules.

For more detailed information on federal mileage reimbursement, please refer to Publication 15, Circular Ehttp://www.irs.gov/pub/irs-pdf/p15.pdf, and Employer’s Tax Guide; Publication 1542, Per Diem Rateshttp://www.irs.gov/pub/irs-pdf/p1542.pdf.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

The nursing home was alerted to the post after a nursing professor saw the post and shared it with the administration.

Although there have been a number of firings of nursing staff based off of their social media posts over the past few years, many of them deal with patient confidentiality. In this case, the employee’s violation of the nursing home’s social media policy– which he had signed with the receipt of his first paycheck– was what protected the nursing home from having to pay costly unemployment benefits to an employee who put patient safety and the reputation of the facility on the line.

If you haven’t already, it may be time to review your current social media policy to ensure that your mission, and reputation, are protected from similar situations.

Read more about the case in this article by the Nonprofit Quarterly.

A: Typically the temporary agency will ensure that their employees know the position they are filling is a temporary assignment. However, if you want to make it perfectly clear, you could ask the temporary agency to give them a letter of understanding structured like an offer letter (on the agency’s letterhead) outlining that the position is temporary through the agency and is expected to continue through [date], that they are ineligible for the contracting company benefits as they are not employees of [company], their employer of record is XX temporary agency, etc. This should ensure that there is no confusion concerning the promise of employment with the contracting company.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.

This newest partnership will allow U.S. based organizations with a 501(c)(3) tax designation to more effectively take advantage of the federal law that allows nonprofits to opt out of the state unemployment tax system. By paying only the dollar-for-dollar cost of unemployment benefits paid to former employees, organizations that join UST lower their average claims cost to just $2,287 per claim versus the national average of $5,174 per claim.

“The ultimate goal of each and every nonprofit association that we work with is to provide their members with the best opportunities to advance their missions. By combining the power of hundreds, and sometimes even thousands, of smaller nonprofits, associations are able to get better money saving tools customized for their members,” said Donna Groh, Executive Director of UST.

“Last year we found more than $3.5 million in tax savings for nonprofits that came to us through our association partnerships. This year we want to double that and find at least $7 million in tax savings for our affinity partners’ member organizations.”

About the Alliance for Children and Families: The Alliance is a national organization dedicated to achieving a vision of a healthy society and strong communities for all children, adults, and families. The Alliance works for transformational change by representing and supporting its network of hundreds of nonprofit human serving organizations across North America as they translate knowledge into best practices that improve their communities. Working with and through its member network on leadership and advocacy, the Alliance strives to achieve high impact by reducing the number of people living in poverty; increasing the number of people with opportunities to live healthy lives; and increasing the number of people with access to educational and employment success. For more information, visit Alliance1.org. About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

The Unemployment Services Trust (UST) is pleased to announce that the Delaware Alliance for Nonprofit Advancement (DANA) has endorsed UST as a new Affinity Partner—making DANA the 15th state nonprofit association to bring UST to their members. UST will now join the other cost-saving member benefits offered to DANA member organizations and will offer resources to help them maintain HR best practices and standards, and reduce unemployment-related costs.

The UST program helps 501(c)(3) organizations take advantage of the federal law that allows nonprofits to opt out of the state unemployment tax system. By paying only the dollar-for-dollar cost of unemployment benefits paid to former employees, organizations that join the Trust see their average unemployment claim cost fall to $2,287, versus the national average of $5,174 per claim.

“We are thrilled to have DANA join us as an Affinity Partner because we know there is ample opportunity to help their members thrive. We want to help Delaware agencies, with 10 or more employees, discover whether they are overpaying their state unemployment taxes,” explained Donna Groh, Executive Director of UST. “We make it our mission to provide nonprofits with the latest tools and information required for organizational growth – and having the power to better educate these Delaware nonprofits through DANA can only help us strengthen the nonprofit sector.”

“We are proud to partner with UST to bring their unemployment and HR resources to Delaware,” says Chris Grundner, President and CEO of DANA. “We’ve seen the impact and savings they provide in other states, and we’re glad to now see our members benefit from their expertise and high-quality customer service.”

About the Delaware Alliance for Nonprofit Advancement (DANA): As a leader of the nonprofit sector, DANA’s mission is to strengthen, enhance, and advance nonprofits and the sector in Delaware through advocacy, training, capacity building, and research. For more information, visit DANA’s website at www.DelawareNonprofit.org.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with nearly 80 state and national nonprofit-based associations to teach their members about their unemployment insurance options. Visit www.ChooseUST.org to learn more.

Written by Karen Beavor and re-published by permission of the Georgia Center for Nonprofits Just as important as developing a deep individual relationship with each board member, it’s also important to understand what your team of individuals amounts to, and what qualities, skills, and connections it still needs to fulfill all your organization’s strategic goals—that is, to become a well-rounded, fully-functional superteam capable of taking on any challenge. If constructed wisely, your board can work as your organization’s personal consulting team.

To figure out what kinds of individuals your team has, and what skills it still needs, you need a process for discerning assets and talent gaps on your board, in relation to your strategic goals. To do that, I advocate laying out your strategic goals and the skill sets necessary to achieve those goals, then determining which of those skill-sets your board already has on-hand. In our years training nonprofit EDs and boards, Georgia Center for Nonprofits has developed a simple method for producing three handy reference charts that will align your organization’s goals with the skills available from the board. Properly aligned, that board can effectively drive initiatives to success, through advisement, the ability to connect or uncover resources, or literally by leading problem solving.

Moreover, when building a team, it is important to understand that you are also building a culture. Paying attention to the kind of board culture you want, and interviewing candidates for attributes as well as skills, will ensure that the board is in full alignment with the needs and values of the organization.

By implementing an intentional process for discerning strengths and gaps on the board, vetting candidates and prioritizing them appropriately, you’ll find not only that your candidates are better suited to the work at hand, but that new members will begin their tenure with clearly-defined roles.

A sample Strategic Needs Table, listing strategic goals and the skill sets needed to execute the strategies involved. Note that contract expertise is useful for more than one goal, meaning that particular skill-set should be a priority.Our foolproof methodology begins with a Strategic Needs Table.

Start by placing your organization’s strategic goals across the top row of a table. Think about the strategies you’ve decided on to reach those goals, and list the skill sets you’ll need to accomplish them beneath.

If your goal is to, say, increase the availability of quality affordable housing, one of your strategies might be to purchase and rehabilitate foreclosed properties, then rent them at an affordable rate. For that, you probably need a number of skill sets: real estate expertise to negotiate deals, banking expertise to assist with financing, an attorney to manage contracts, and a contractor for renovation and maintenance.

As you look across all your goals and strategies, you’re also looking for repeating skill-sets. The need for an attorney, for instance, might arise across a number of goals. Therefore, having an attorney on your board might become a priority position to fill. This person could provide legal advisement, connections to other attorneys, or legal resources and guidance.

Before you can determine the types of board members you need to recruit, you’ve got to understand who on the board already understands the ins and outs of each strategy. To do that, you’ll need to construct a Current Board Inventory.

That means creating another table, this one listing the skill-sets identified by your Strategic Needs Table across the top row, and your current board members down the left-hand column. For each board member, put a check beneath the skill sets they possess. If you don’t yet know your board members well enough to make an accurate inventory—and don’t assume you do—I advise creating a short survey that you can send through email or conduct over the phone. Be sure to ask about current and past employment; significant hobbies; major corporate, philanthropic, or donor relationships; professional association involvement; political positions held; and any other boards served on. You may be surprised!

With your board inventory finished, you should be able to see, at a glance, the strengths your board possesses and the gaps that need filling. That table should allow you to create a prioritized list of skills, talents, and connections you must seek in the next board members you recruit.

You should also take time to decide what you want in your next recruit, because you are creating a board culture as much as you’re seeking skills—and it won’t matter how many strategic needs a particular candidate fills if there’s no cultural fit. If they can’t connect with your organization, chances are they won’t stick around long enough make an impact.

To come up with a list of desired cultural attributes, think about the foundational values of your organization, the work style of your staff and programs, and the qualities you most appreciate in the board members you have. These might include an affinity for improvisation (or for long-term planning); an attitude of positivity and agreeableness (or skepticism and challenge); a certain geographic reach; a kind of diversity (racial, gender, socioeconomic, political); a particular community connection; or the ability to make a personal gift, or to get others to give. (At one nonprofit we work with, the key attribute is “nice.” That’s their code for assertive and positive, rather than contentious or argumentative.)

Once you’ve decided on these key attributes, you can create a Recruit Attributes Chart, much like the Current Board Inventory, accounting for these qualities in the candidates you interview. With that table, you can prioritize recruits who fulfill the same skill-set by their “fit”: that is, how many cultural attributes one marketing expert fulfills compared to the other marketing experts you’re interviewing.

Of course, all of this is just preparation for your real work with the board: empowering your organization to fulfill all the promise of its mission. From here, it’s up to you to develop a purposeful, intentional plan that takes advantage of all the skills and strengths your board members possess.

Access more GCN resources on board building and engagement at GCN.org/Boards.

Karen Beavor is President and CEO of the Georgia Center for Nonprofits. Since 1998, Beavor has led GCN’s growth into a leading state association empowering nonprofits through education, advocacy, research, consulting and business support services. Karen has served as a board member or advisory board member of a variety of civic and nonprofit organizations including the Unemployment Services Trust; National Nonprofit Risk Management Center; and The Foundation Center–Atlanta. Karen has received the Martin Luther King Leadership award and the Harvard Business School Club of Atlanta’s Community Leader Award. She is a member of the 2000 class of Leadership Atlanta and 2003 Coca-Cola Diversity Leadership Academy, and a graduate of Agnes Scott College. About Georgia enter for Nonprofits

The Georgia Center for Nonprofits builds thriving communities by helping nonprofits succeed. Through a powerful mix of advocacy, solutions for nonprofit effectiveness, and insight building tools, GCN provides nonprofits, board members, and donors with the tools they need to strengthen organizations that make a difference on important causes throughout Georgia. Learn more at gcn.org.

For large organizations, or organizations that expect high turnover year-over-year, that number may not be particularly compelling. But for organizations in which high turnover is a sign of a bigger problem, this kind of turnover needs to be looked at as an opportunity for improvement.

Looking more closely at the reasons for separation, nearly 60% of all turnover last year was voluntary. And—including both voluntary and involuntary separation data—about 40% of separations happened when the employee had been in the position less than 6 months.

The cost of turnover can be monumental.

Even for employees that have only recently joined the organization, the cost of replacing them can be mind boggling.

Consider this: the average cost of turnover is typically reported between 15 and 21% of the employee’s salary. But the ‘actual cost’ consists of the time and resources that are spent recruiting and hiring a replacement, greater demands on other employees to pick up the slack (which could lead to burn out and more employee openings), the need to train and develop the new employee, and potentially lost revenue and opportunities.

To stay competitive and to reduce the amount of voluntary turnover as efficiently and effectively as possible, it’s time for employers to dust off their research skills and learn more about what factors are encouraging employees to leave your organization.

Conduct exit interviews, and find out why employees are leaving your organization. Dig deep into the reasons that employees are leaving—is there a toxic employee rotting the rest of their department? Is the amount of work incongruent with the amount of pay? Are poor benefits or strict working hours causing employees to look elsewhere?

Once definitive information has been collected and examined, take the time to address it throughout the organization. Make changes where necessary. And if changes can’t occur, for instance if better benefits are too hard to provide, look for opportunities to become more flexible with employees.

The savings will quickly add up.

Read more about how to see voluntary turnover as an opportunity here.

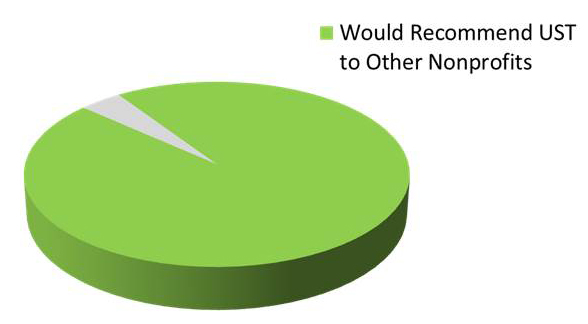

The Unemployment Services Trust (UST) is proud to announce that 96 percent of current participants would recommend the program as a valuable cost-saving opportunity for nonprofits. UST credits the improvement over last year’s 93 percent recommendation rate to an intense focus on the overall member experience and greater attentiveness to members’ needs.

“From the very beginning, the UST program was designed to support nonprofits by reducing the time and cost associated with managing an unemployment claim,” said Donna Groh, Executive Director. “To have found that our members would overwhelmingly recommend our service to other nonprofits is extremely rewarding.”

“We’ve worked hard to improve our customer service model and increase the quality of interactions that our customer service team has with our current members over the past year,” said Adam Thorn, Director of Operations. “By incorporating best practices and higher customer service standards, we have been able to support more in-depth interactions with our members, whether that means providing more detailed responses to questions or better educating organizations about the benefits of reimbursing for unemployment claims versus paying taxes.”

“On the heels of this increase in customer service standards was the increase in direct savings that our members experienced last year as well,” said Groh in reference to mitigated unemployment claims costs and cash back to participants.

Last year, UST was able to help members mitigate $32,598,054 in unemployment claims through best-in-class claims management. The same claims management services allowed UST to return an additional $1.7 million of charges made in error by state unemployment offices, which were audited by UST and credited back to the individual organizations.

Select participants also received $11,041,738 in cash back after their reserve accounts were reviewed for positive claims experience.

How your employees approach their responsibilities and relationships within your organization dictates its level of success. However, how you choose to conduct yourself as a leader sets the tone for your employees’ overarching sense of accountability—which can create either a trusting, or toxic, work environment.

In order to be a great leader, one must educate, coach, empathize, encourage, and sometimes discipline employees. According to Simon Sinek, who was recently featured in TED2014, being a good leader is like being a parent –the main objective is to provide your workers the necessary tools to be successful and grow. Holding your employees accountable for their actions allows them to take ownership of their actions, and forces them to take responsibility for their successes and failures.

For nonprofits, who are often restricted by budgetary concessions, high morale and cooperation are driving forces required for mission advancement. Such internal drive can only be cultivated through feelings of security.

When employees feel as though they are being looked after and respected by their leaders, they develop a greater willingness to take initiative.

Great leaders also sacrifice for the well-being and safety of their staff. Selfless actions from a leadership figure will cause a domino effect of trust within an organization. And when the relationship between employer and employee improves, employees spend more time and energy devoted to strengthening the organization as a whole.

To learn more about what it takes to be a great leader, watch Simon Sinek’s video.

Read more about leadership management tips here.

Her drive and passion to spread awareness within the community makes her a great fit for the UST team. Laurie explains, “I am not doing any volunteer work currently, but when my father passed away from cancer 10 years ago, one of the ways I got through it was to get involved with the American Cancer Society’s Relay for Life fundraisers in Ventura.”

Outside of the office, Laurie and her husband are adjusting to life as newfound puppy parents. They’re rescue puppy, Watson, is a Dachshund/Corgi mix and makes a wonderful addition to their household.

When given the opportunity, Laurie can’t resist the tranquility of nature. “Camping is probably my favorite thing to do and my husband and I go at least twice a year – sometimes more,” she says. “My favorite camping trip was years ago with my sister and some friends and we went on a 50 mile (2 ½ day) river rafting trip on the Colorado River from Grand Junction, CO to Moab, UT…definitely one of the best trips I’ve ever been on!”

In addition to being a dog lover and camping enthusiast, Laurie likes to let loose with a little help from her buddy, Bruce. If her life was a TV show, Laurie would select Growin’ Up by Bruce Springsteen as a theme song that played every time she walked into a room. “This represents the music I grew up with and sometimes I don’t think I’m finished growing up.”

Are you a fan of Bruce Springsteen too? Tell Laurie about it @USTTrust with the hashtag #MeetUSTMondays!

Highlighting the biggest problems that the delays in funding create, including reducing and/or putting staff pay on hold, the reports aim to introduce public policy proposals that would streamline the contracting process.

Some of the top findings from the survey included identifying the primary places and reasons contract payment is delayed and that:

Read more about the summary findings here.

Read the full study by the National Council of Nonprofits here. And read the full Urban Institute study here.

Since the Great Recession took its initial toll on the state unemployment insurance (UI) funds, states across the U.S. have gone into considerable debt in order to provide benefits for millions of unemployed. Trying to combat unemployment costs while restoring their debt with the federal government, many states look towards alternative measures to repair their financial foundations.

In 2011, states accumulated a debt of over $47 billion owed to the federal government– the peak of the United States’ economic deficit. While the federal debt has since decreased, with 16 states still owing over $21 billion at the beginning of 2014, a lot of states took out private loans to avoid an automatic increase in their federal unemployment tax on employers.

With a low UI trust fund balance, many states have been forced to cut their unemployment benefits, rather than borrowing additional money from the government. Other alternative methods used to reach state solvency include:

Such actions were meant to diminish volatility and recover sensibly from the impact of the debt.

While the states have steadily reduced the debts triggered by the Great Recession, the U.S. has a long way to go before they achieve full economic restoration. And employers will continue to see their overall cost of unemployment steadily rising, if their state is to both recover and prepare for the next downturn.

To see how your state unemployment insurance trust fund debt compares to other states, view Stateline’s chart here.

Learn more about how the U.S. is affected by the unemployment trust fund debt here.

One of our dedicated Unemployment Cost Advisors, Adriana works one-on-one with nonprofits looking to save on HR costs and helps evaluate their savings potential.

“Nonprofits work extremely hard to fill the gaps where people find themselves struggling the hardest; and helping those nonprofits save time and money that can be put back into their mission is very gratifying.”

Outside of work Adriana is a dog lover, enjoys gardening and hiking, and has plans to camp under the Aurora Borealis someday.

“Wandering around in nature with friends for a couple of hours is the best form of stress release,” she said, which also translates into her recently planted garden. “I never thought I’d get into gardening, but it’s been rewarding to see the results of our hard work. And it’s also delicious!”

Want to set up a time with me to learn more about how UST can help your organization save on HR costs? Tweet me at @USTTrust with #MeetUSTMondays.

An analysis by UWC- Strategic Services on Unemployment & Workers’ Compensation reveals that a number of states have state UI trust funds that are so insolvent they are unlikely to recover before the next recession. For employers in these states (listed below) it can be expected that state and/or FUTA tax rates will continue to rise with longer term restrictions being imposed on benefit increases alongside enhanced integrity efforts.

While some states have elected not to maintain a large trust fund balance and are relying on “just in time” supplemental funds to assure their solvency, many are using bonds to supplement UI taxes and remain strained.

States not meeting the 0.5 Average High Cost Multiple threshold as of December 31, 2013 include:

Alabama, Arkansas, Arizona, California, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Kansas, Kentucky, Massachusetts, Missouri, North Carolina, New Jersey, Nevada, New York, Ohio, Pennsylvania, Rhode Island, South Carolina, Texas, Virgin Islands, Virginia, Wisconsin, West Virginia

States that do not meet the DOL recommended levels but have average High Cost Multiples of 0.5 or more include:

Colorado, DC, Hawaii, Maryland, Maine, Michigan, Minnesota, Puerto Rico, Vermont

States that have solvent UI trust fund balances according to the US DOL 1.0 Average High Cost Multiple formula include:

Alaska, Iowa, Idaho, Louisiana, Mississippi, Montana, North Dakota, Nebraska, New Hampshire, Oklahoma, Oregon, South Dakota, Utah, Washington, Wyoming

Few nonprofits are successful without a carefully managed budget though. And that’s why everything UST does is designed to save our participants time and money. By providing world-class unemployment claims administration, a live HR hotline with expert HR personnel and an exhaustive resource library, as well as online claims monitoring, organizations that join UST see their average unemployment claim cost drop to $2,287, compared to the national average of $5,174 per claim.

How the Unemployment Services Trust Helps Nonprofits Save Money

For more information about this years’ Mental Health Month, visit our partner MHA. Or download one of their mental health toolkits that are full of tips and tools for taking positive actions to protect mental health and promote whole health.

The relationship between HSC and UST will allow many more 501(c)(3) organizations to learn how to lower the cost of unemployment at their organization by opting out of the state unemployment insurance tax system and implementing best practices. By paying only the dollar-for-dollar cost of unemployment benefits awarded to former employees, organizations that join UST lower their average claims cost to just $2,287 per claim versus the national average of $5,174 per claim.

“Not only will this new partnership result in potential savings for HSC members,” explained Judy Zangwill, Executive Director of Sunnyside Community Services, who sits on the Board of Directors at HSC and is also a UST Trustee, “but there are also additional benefits in terms of gaining access to the ThinkHR hotline and training, and getting 100% representation at all unemployment claim hearings when an organization joins UST.”

“As a Trust member I knew that UST helps nonprofit organizations from the time an employee initially files for unemployment benefits to the end of the claims experience. But as a UST Trustee I have even greater insight into the program and can see that it’s not only efficient for members, it’s also a well-run organization that provides increased value for its 80 Affinity Partners.”

About the Human Services Council: HSC strengthens the not-for-profit human services sector’s ability to improve the lives of New Yorkers in need through networking, advocacy, research, media education and by acting collectively to establish greater balance between organizations and government. As a membership association HSC has long been at the forefront of enacting positive changes to outdated, bureaucratic governmental systems that human services providers must navigate to help those in need. In service to their members, HSC seeks to reduce regulatory burdens while strengthening accountability—with the overall goal of producing better outcomes for clients. Their efforts enhance public recognition of the sector, improve its financial stability, and have a long-term positive impact on the well-being of New Yorkers in need. For more information, visit humanservicescouncil.org.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

“Wait, wait,” you might shout. “My organization gives employees all of those things.” And chances are, you’re right. But sometimes employees find that the day-to-day business of operating a nonprofit gets in the way of feeling that they are a part of something.

Worse, a disconnect between daily tasks and feeling a sense of purpose can lead to frustration in your employees. Hurst cites one high-level executive who made the switch from the nonprofit sector to the corporate world because she didn’t feel her work was impacting the mission of her organization.

But what is your organization supposed to do? How do you re-engage employees that feel their contribution doesn’t affect the overall mission of your organization?

Hurst explains that his 3 mantras are:

We’ve added a few additional suggestions though.

Every day is Earth Day for nonprofit members of the Unemployment Services Trust (UST) who are reducing their paper trail. More than 91% of the organizations that participate in the UST program now handle the details and filing of their unemployment claims online. 68% of UST members are participating in the online unemployment claim dashboard that allows them to view claims detail related to their organization and process information requests from the state. And an additional 23% of UST members have elected secure email channels as their method of claims response, further eliminating paper waste and increasing the speed of communication.

“This green initiative is our small way of contributing toward reducing our carbon footprint, and also making life easier for our nonprofit members,” says Adam Thorn, UST’s Director of Operations.

Thorn explains, “Last year the federal government mandated that state penalties should be imposed if an employer does not respond in a timely manner to the state’s request for information on an unemployment claim. The response window is often a week or less, so being able to e-file claims information helps mitigate the risk of non-compliance and helps us be a more eco-friendly program. It’s a win-win.”

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives. Visit www.ChooseUST.org to learn more.

The UST program allows member organizations with a 501(c)(3) tax designation to better take advantage of the federal law that allows nonprofits to opt out of paying state unemployment taxes. By paying only the dollar-for-dollar cost of unemployment benefits paid to former employees, organizations that join UST lower their average claims cost to just $2,287 per claim, versus the national average of $5,174 per claim.

“We are very excited about this program because we know there is a lot of opportunity to save in the sector. We want to help foster care agencies with 10 or more employees to evaluate whether they are paying too much into the state unemployment tax system – and if so, we will provide them with a free 2-year savings projection,” said Donna Groh, Executive Director of UST. “Our goal is to find $7 million in tax savings for nonprofits this year, and being able to reach out to foster-family organizations through the FFTA will certainly help us reach that goal.”

Groh added, “Since so many organizations don’t have the bandwidth or resources to make sure they are paying the right amount in unemployment taxes, or staying in compliance with every new HR law, UST’s expert claims advisors and HR hotline gives them the edge they need to continue to thrive and meet their missions.”

About the Foster Family-based Treatment Association (FFTA): Established in 1998, the Foster Family-based Treatment Association (FFTA) is the leader in Treatment Foster Care, dedicated to strengthening agencies that support families caring for vulnerable children. Its membership of over 400 agencies provides an array of child welfare and mental health services to over 600,000 vulnerable children and youth each year. Treatment Foster Care is provided to children and youth with significant emotional, behavioral and medical problems who receive intensive and therapeutic services in a family-based setting, with the support of specially trained foster parents and clinical staff. For more information, visit http://www.ffta.org.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with nearly 80 state and national nonprofit-based associations to teach their members about their unemployment insurance options. Visit www.ChooseUST.org to learn more.

Last year the Unemployment Services Trust (UST) identified $3,532,485.26 in unemployment tax savings opportunities for more than 200 nonprofits that requested a Savings Evaluation. Additionally, UST found $1.7 million in state errors that were credited back to current participants in the UST program after state charges were carefully audited by the claims administrator.

Based on research conducted by the UST Division of Nonprofit Research last year, 1 in 4 nonprofits is unaware of the legislation that allows 501(c)(3)s to opt out of paying state unemployment taxes and instead directly reimburse the state for the dollar-for-dollar cost of benefits paid to their former employees. UST helps nonprofits determine if this alternative will save them money by analyzing their past few years of unemployment claims. Savings can be as much as 60 percent.

“This year our goal is to find more than $7 million in potential savings for nonprofits that ask us to compare UST to their state unemployment tax rate or current supported reimbursing program. Too many organizations are overpaying for their unemployment costs, and we hope to help change that by putting more unrestricted funding back into their budgets when they take advantage of the UST Program.”

For most organizations that join UST, the savings add up quickly. Steve Lepinski, Executive Director of the Washburn Center for Children in Minneapolis and a long-time UST Trustee, said, “The savings generated by UST are like a large foundation has provided millions of dollars to nonprofits across the country.”

His organization estimates that it has saved more than $100,000 on unemployment costs since joining the UST program.

About UST: Founded by nonprofits, for nonprofits, UST is the largest unemployment trust in the nation, providing nonprofit organizations with 10 or more employees a safe, cost-effective alternative to paying state unemployment taxes. UST has partnered with 80 state and national nonprofit-based associations to teach their members about their unemployment insurance alternatives.

Hobbled by limited budgets for recruitment, historically lower pay scales, and fewer opportunities for internal advancement (the largest majority of mid-level employees come from other nonprofit organizations), nonprofits have a lot working against them when it comes time to hire. So what is a nonprofit to do when they need to source appropriate applications and hire the best candidates to advance their mission?

Let’s start by ensuring job postings are in the right place and reaching the most relevant candidates.

Rather than relying solely on word-of-mouth advertising through the nonprofit community, or on your informal network of connections, become active in sourcing candidates from the very field you want to hire for. You never know which job seekers are looking for the opportunity to leave the corporate structure in favor of an organization whose mission they are passionate about.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

UST maintains a secure site. This means that information we obtain from you in the process of enrolling is protected and cannot be viewed by others. Information about your agency is provided to our various service providers once you enroll in UST for the purpose of providing you with the best possible service. Your information will never be sold or rented to other entities that are not affiliated with UST. Agencies that are actively enrolled in UST are listed for review by other agencies, UST’s sponsors and potential participants, but no information specific to your agency can be reviewed by anyone not affiliated with UST and not otherwise engaged in providing services to you except as required by law or valid legal process.

Your use of this site and the provision of basic information constitute your consent for UST to use the information supplied.

UST may collect generic information about overall website traffic, and use other analytical information and tools to help us improve our website and provide the best possible information and service. As you browse UST’s website, cookies may also be placed on your computer so that we can better understand what information our visitors are most interested in, and to help direct you to other relevant information. These cookies do not collect personal information such as your name, email, postal address or phone number. To opt out of some of these cookies, click here. If you are a Twitter user, and prefer not to have Twitter ad content tailored to you, learn more here.

Further, our website may contain links to other sites. Anytime you connect to another website, their respective privacy policy will apply and UST is not responsible for the privacy practices of others.

This Privacy Policy and the Terms of Use for our site is subject to change.

Q: When an employee has reported another employee to the police for a non-work-related activity, what is the employer’s liability?

A: If the employee in question has not done anything illegal or against company policy in the workplace, the employer is not required to take any action. However, the concern may be that the workplace may become a charged environment between these two employees.

The employer should monitor the environment at work, focusing on job performance and productivity, while remaining aware of the possibility of existing conflict between the two employees that may create a hostile environment or a distraction for those working nearby.

If either individual creates a conflict in the workplace, the employer should address it immediately and counsel the offender. Written documentation of any event should occur.

An employee whose behavior is questionable outside of the workplace may not be disciplined or singled out by the employer. However, the employer has the responsibility to ensure that no employee is subjected to a hostile work environment and will want to be aware of any conflict amongst the individuals. Additionally, no action should occur until such time as an employee is convicted of any alleged complaint, nor should any perceived act of retaliation exist.

Question and Answer provided by ThinkHR. Learn more about how your nonprofit can gain access to their expert HR staff here.